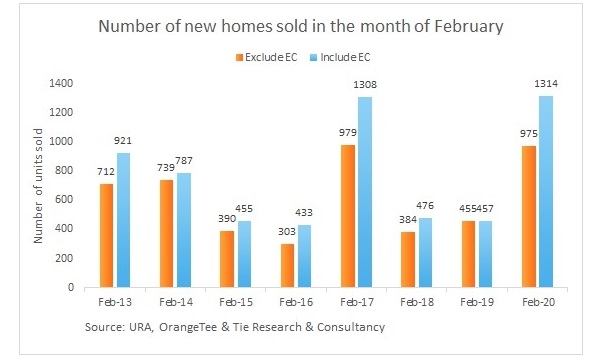

February new home sales surged 57.3% to 975 units: URA

More investors are looking to diversify portfolios after the stock market’s fallout.

New home sales jumped 57.3% MoM to 975 units in February from only 620 units sold in January, according to data from the Urban Redevelopment Authority (URA). Including executive condominium (EC) units, new home sales skyrocketed 105.3% MoM to 1,324 units from 640 units over the same period of comparison.

Christine Sun, head of research & consultancy at OrangTee & Tie, noted that this is the second-highest February sales in eight years, just slightly below the 979 units inked in February 2017. “The surge in sales may be attributed to more investors diversifying their portfolios to property investments after the recent stock market rout”.

There were two notable projects in February, the first of which is the 522-unit The M that sold 380 units; and the 496-unit Parc Canberra EC, which moved 324 units. Excluding these two launches, 610 units were sold collectively at other projects which is almost on par with the total units transacted in January (640 units).

URA Realis data also showed that 812 non-landed homes, excluding EC, were bought by Singaporeans last month, up from the 413 units transacted in January 2020 and 351 units in December 2019.

Meanwhile, the number of foreign buyers jumped from 116 in December 2019 to 149 units in February, as investors reposition their portfolios with stability in mind.

“Moving forward, the increasing volatility of the financial markets may continue to propel investors to the real estate sector as properties are widely regarded as safe-haven assets that offer more stable returns than other investment types. The softening of the Singapore dollar in recent months may attract foreigners to invest in properties here,” Sun said.

She added that the slashed interest rates of the Federal Reserve and the restart of its quantitative easing programme are intended to spur lending. It may continue to stimulate housing demand with the increased liquidity.

Homeowners may refinance their housing loans, whilst some buyers may purchase larger housing units in the coming months given the increased affordability.

Advertise

Advertise