Chart from EDMUND TIE

Chart from EDMUND TIE

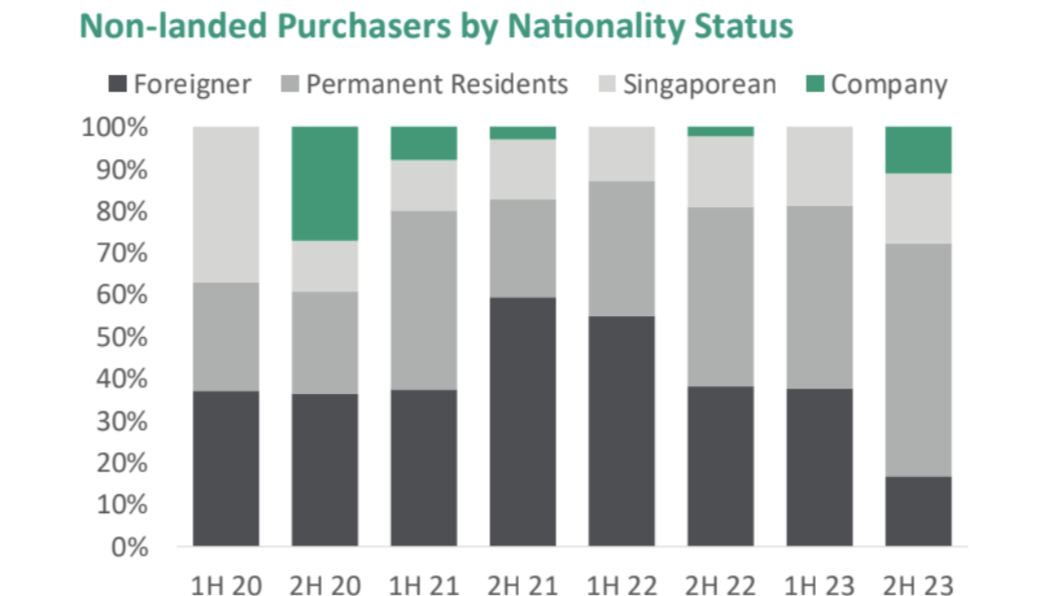

Foreign demand for non-landed luxury homes wanes

Transactions by foreign purchasers fell by 50% to 13 in 2H23.

The April 2023 ABSD hike has left a significant impact on the non-landed luxury market, with transactions by foreign purchasers, including permanent residents, dwindling by 50.0% to 13 in 2H23.

Data from EDMUND TIE showed that the total quantum from foreign demand also fell in 2H23, declining 55.7% HoH to $196.9m.

Chinese nationals retained their dominance in the market.

“In 2H 2023, Chinese nationals bought 6 out of 7 units, with a notable increase in purchases by Permanent Residents (PRs). This marks a shift from 1H23 when there were ten transactions by Chinese nationals, among which only one involved a PR,” EDMUND TIE reported.

“This trend indicates a growing preference among Chinese nationals for PR status, likely influenced by the lower Additional Buyer’s Stamp Duty (ABSD) rates applicable to PRs compared to non-permanent residents (NPRs),” the expert added.

EDMUND TIE said NPRs, particularly those engaged in work or business in Singapore, are exploring alternative accommodation

options such as renting.

“This shift in behaviour is largely influenced by the substantial 60% ABSD levied on property purchases for NPRs, prompting them to assess

their investment strategies in light of the considerable cost of entry,” the expert said.

Advertise

Advertise