Photo by Danist Soh from Unsplash

Photo by Danist Soh from Unsplash

Gov't to offer rebates for owner-occupied residential properties amidst looming tax hike

The property tax will increase on 1 January 2024.

The government will offer up to 100% tax rebates for all owner-occupied residential properties in response to the looming property tax (PT) hike in 2024.

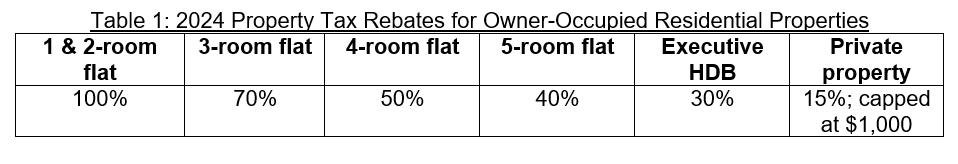

The rebates are as follows:

With the PT rebate, all one- and two-room HDB owner-occupiers will continue to pay no PT in 2024.

Rebates for owner-occupiers in other HDB flat types will be automatically offset against any PT payable, with an average PT increase of less than $3 per month.

For private property owner-occupiers, the rebate will also be automatically offset against any PT payable.

The bottom half of private property owner-occupiers will experience a PT increase of less than $15 per month. The increase in PT will be higher for those with higher-value properties.

The government will release Annual Values (AVs) thresholds for social support schemes from January 2024.

"The rebate is tiered to ensure that our PT regime remains progressive, and those with greater means pay their fair share of taxes," the Ministry of Finance said."

Property take hike

In 2024, property taxes for most residential properties will increase 2024 amidst the higher market rents, AV, and PT rates for higher-value residential properties.

The PT increase will take effect from 1 January 2024, along with the increase in AVs for HDB and most private residential properties. AV is used to compute the PT payable by property owners.

This increase will affect non-owner-occupied residential properties and owner-occupied residential properties with an AV of more than $30,000.

Owner-occupied residential properties will receive lower PT rates than residential properties that are rented out.

Advertise

Advertise