/Cyrill from Pexels

/Cyrill from Pexels

HDB resale prices to climb 5% in 2024

Competition in the housing market may intensify in the latter half of 2024, says OrangeTee.

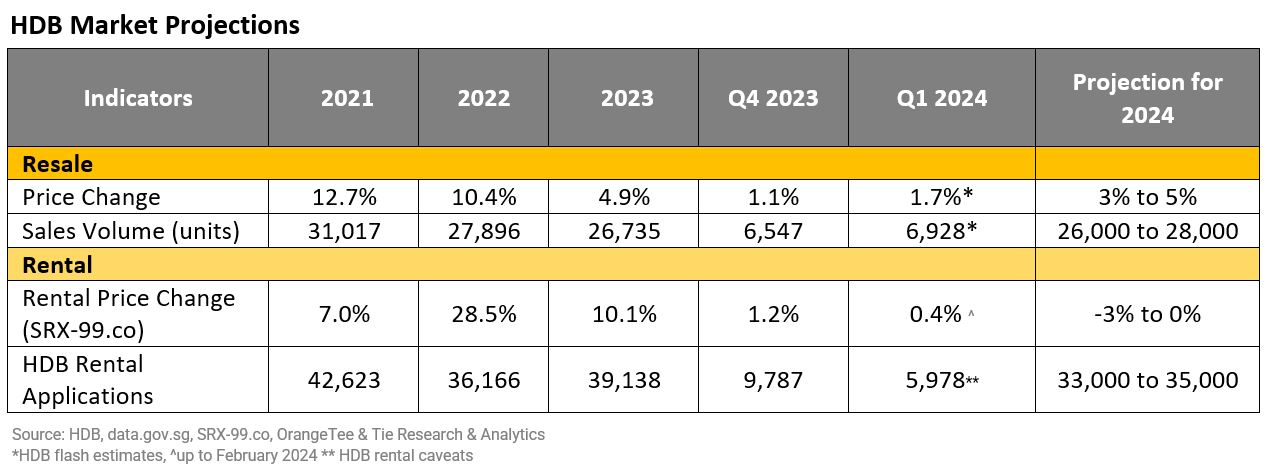

The Housing Development Board (HDB) has reported a significant acceleration in resale prices during the first quarter of 2024 (Q124), with prices rising by 1.7%, marking the 16th consecutive quarter of growth.

This increase is notably higher than the 1.1% growth observed in the previous quarter and reflects a robust demand for resale flats, according to OrangeTee’s latest HDB Resale Trends Q1 2024 report.

More first-time buyers are opting to purchase flats from the secondary market rather than waiting for Built-to-Order (BTO) sales launches. This shift in behaviour has been facilitated by HDB's modification of the frequency of BTO sales launches to three times a year and the conduct of the Sales of Balance Flat (SBF) exercise once a year.

“There has been a surge in demand for resale flats as more first-time buyers chose to purchase flats from the secondary market instead of waiting for the BTO sales launches. HDB modified the frequency of BTO sales launches to three times a year from the previous four, and the Sales of Balance Flat (SBF) exercise will be conducted once a year,” Christine Sun, chief researcher & strategist of OrangeTee Group said in a note.

An increasing number of private property owners have completed the mandatory 15-month wait-out period, leading to a surge in demand, particularly for larger units.

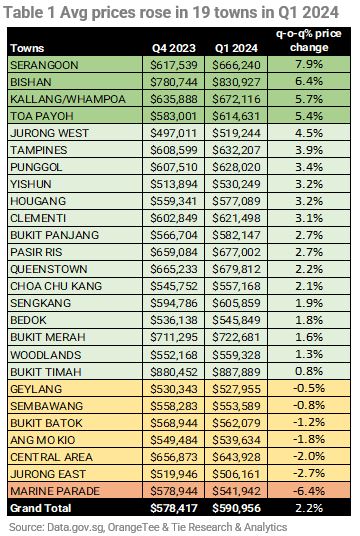

Average prices have risen in 19 out of 26 towns in Q124, compared to just 14 towns in the preceding quarter. The largest gains were observed in Serangoon (7.9%), Bishan (6.4%), Kallang/Whampoa (5.7%), and Toa Payoh (5.4%).

Five-room and executive flats experienced the highest price increases, rising by 1.5% and 1.8%, respectively, outpacing the growth of four-room flats (1.3%). Two-room and three-room flats also increased significantly, climbing by 1.8% and 1.7%, respectively.

Resale volume in Q124 increased by 5.5% compared to the same period last year, reaching 6,928 units. This growth is uncommon for the first quarter, as historical data shows lower sales during this period due to Chinese New Year festivities and March school holidays.

The proportion of five-room and executive flats increased from 27.8% in Q4 2023 to 29.9% in Q1 2024, driven by more private homeowners downsizing to HDB flats.

ALSO READ: Larger flats and million-dollar transactions drive HDB resale flats momentum

Specifically, five-room flat transactions surged by 15.9%, followed by executive flats at 13.8%, indicating a preference for larger units.

During the quarter, a new record was set with 185 resale flats sold for over a million dollars, surpassing the previous record of 133 units in Q423.

Nonmature estates saw an increase in million-dollar transactions, rising to 8.1% from 7.7% in 2023 and 6% in 2022.

Notably, 76 five-room and 53 executive flats were sold for over a million dollars each, marking record numbers. The highest-priced transactions were two five-room DBSS units in Toa Payoh, selling for $1.57m and $1.54m in January 2024.

Outlook

Demand from first-time homebuyers and private homeowners downsizing from private properties is anticipated to continue bolstering prices of HDB resale flats in Singapore.

The sustained demand, particularly in sought-after locations such as mature estates and areas near amenities like schools, public transportation, and shopping malls, is expected to keep prices stable or even trend higher in the coming years.

“Moreover, the limited supply of flats in some locations is likely to keep prices stable or even trend higher in the upcoming years. For example, the number of flats that have reached their five-year Minimum Occupation Period (MOP) has decreased from 30,920 units in 2022 to 15,549 units in 2023. It is projected to drop further in 2024 to 11,952 units, which means that there will be fewer flats available for resale,” Sun said.

However, competition in the housing market may intensify in the latter half of 2024 following the launch of new Plus flats by the government.

Despite stricter buying and selling restrictions and an extended minimum occupation period of ten years, the advantageous location of these flats may attract some first-time buyers.

“Taking various factors into consideration, it is expected that resale prices may rise moderately by up to 5% in 2024. This increase is comparable to, or slightly lower than, the 4.9% growth observed in 2023.” concluded Sun.

Advertise

Advertise