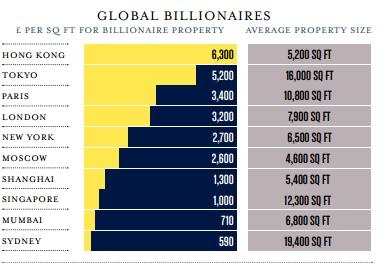

Here’s how costly homes owned by Singapore’s super rich are compared with peers

The value of properties owned by Singapore's billionaires grew 14% in 2011, albeit at a slower pace than the 147% recorded five years ago.

According to Savills' World Cities Review 2012 Singapore billionaires have an average property size of 12,300 sq ft, priced at £1,000 per square feet as of final half of 2011. The property value is amongst the cheapest in the 10 world class cities.

The moderated growth of property values by Singapore’s billionaires tracks global downtrend amid latest economic uncertainty.

According to Savills, new billionaires continue to be created in emerging markets, led by China. As a consequence, the value of billionaire property held up better than executive units, recording growth of 3.6% in the second half of 2011.

Here’s more from Savills:

The notable exception is Hong Kong, where billionaire property fell by -5.9%. The city’s red-hot ultra-prime districts, The Peak and Southside, have cooled followingprice growth of 118% between december 2008 and June 2011.

Buyers are exercising caution ahead of anticipated price falls, and are seeking discounts on asking price. Such measures were unheard of just six months ago, and may indicate the market to come.

By contrast, safe-haven cities like New York performed particularly well. The value of billionaire property in New York increased by 17% in the final half of 2011, fuelled by super-wealthy overseas buyers from Russia, China, Brazil and Argentina seeking condominium investments.

London and Paris also saw price growth, with increases of 4% for this type of property. London’s super-prime market saw record sales in excess of £1.9bn in 2011

Advertise

Advertise