Keppel bids higher than expected for a residential site along Upper Changgi Rd

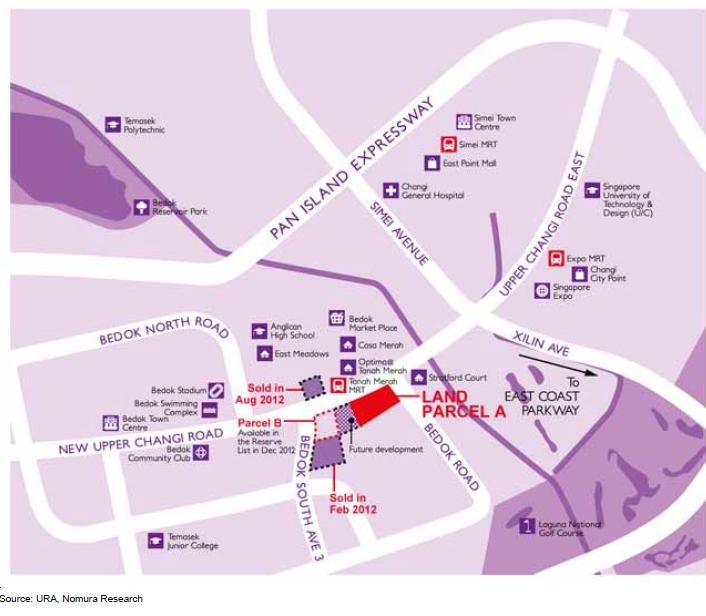

This map will show you why Keppel bids S$791psfppr, 16-25% higher than expected.

The tender for the Upper Changi Road site (99-yr LH, GFA 549,082sqft, c. 540 units) closed on 16 October 2012, with the top bid of S$434.5m (S$791psfppr) submitted by Keppel Land.

The tender attracted 11 bids that ranged from S$275-435m, or S$500- 791psfppr. The winning bid thus works out to a range of 7-58% over the second highest and lowest bidder, respectively, estimates Nomura.

According to Nomura, when the site was first launched in August, consultants had predicted it to attract keen interest from developers, citing proximity to MRT and upcoming Bedok Mall as key drawing factors. The tender was expected to draw 8-12 bids, with a top bid of S$630-680psfppr. KPLD’s bid thus appears to be 16-25% higher than initial expectations.

Was it a fare bid?

Here's from Nomura:

Based on a land cost of S$791psfppr, we estimate the breakeven for the project at S$1,106-1,168psf. If we assume an ASP of S$1,300psf, this works out to a pre-tax profit margin of 11-17%

Developers appear to be bidding more aggressively, likely a reflection of positive market sentiments.

KPLD’s bid of S$791psfppr works out to be 17-48% higher than the earlier plots awarded to Far East JV and Fragrance Group JV in Feb and July respectively this year.

The first of the two above-mentioned plots have since been launched as eCO, debuting in September 2012.

Whilst the bid appears to be aggressive, we note that the ASP appears to be achievable when compared to the recently launched eCO (99-yr, GFA 647,498sqft, c. 748 units), which had managed to sell 402 units (c.54%) as of 30 September 2012, at a S$1,283psf median price tag.

We judge KPLD’s plot to be in a slightly superior location than eCO’s as it is closer to the MRT.

We maintain our view on KPLD; expect overall market response to be neutral Overall, we judge KPLD’s bid to be fair, taking into account the recent momentum in pre-sales which have led to more aggressive bidding by developers. With sales at The Luxurie picking up (project is now c.79% sold), we understand KPLD’s rationale behind the replenishment of its mass market land bank.

Advertise

Advertise