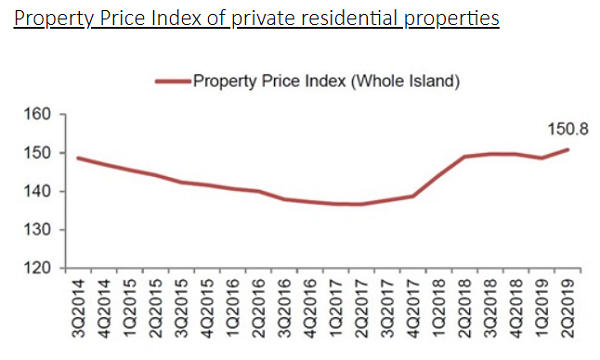

Private home prices rose 1.5% in Q2: URA

Condo prices rose 2% whilst landed property prices fell 0.1%.

Private home prices climbed 1.5%, reversing the 0.7% decline in the previous quarter, according to an Urban Redevelopment Authority report.

Also read: Private home prices down 0.7% in Q1: URA

Landed property prices dipped 0.1% in the same period, after seeing an uptick of 1.1% increase in Q1 whilst condo prices rose 2% following a 1.1% decline in the previous quarter.

Condo prices in the Core Central Region (CCR), Rest of Central Region (RCR) and Outside Central Region (OCR) edged up 2.3%, 3.5% and 0.4%, respectively.

“Higher launch prices of new homes may have contributed to the recent price increases. The higher launch prices are within expectations due to the higher land cost and many projects commanding a price premium due to their excellent location, freehold status, and distinctive designs,” Christine Sun, head of research and consultancy at OrangeTee & Tie, said.

Also read: Residential unit sales up 0.1% in Q1 as luxury home transactions drive gains

Meanwhile, home rentals also grew at a faster rate 1.3% in Q2 from the 1% increase during the previous quarter. Both rentals of landed properties and condominiums edged up 0.3% and 1.4% respectively. Condo rentals in CCR, RCR and OCR climbed 1.5%, 1.4% and 1.2%.

In the same period, developers have launched 2,502 uncompleted private residential units for sale, a lower figure as compared to 2,989 units in Q1. However, the number of units sold went up to 2,350 units from 1,838 units in the previous quarter.

Q2 also saw 2,371 resale transactions, which accounted for 49.7% of all sale transactions during the period. There were 45 sub-sale transactions making up for 0.9% of total sale transactions. Sun added that the number of resale homes rose 27.6% from Q1 to Q2.

As for its supply pipeline, it reached a total of 50,674 uncompleted private home units with planning approvals, comparably lower than the 53,284 units in Q2. Of this number, 33,673 units remained unsold at the end-June. Executive condominiums (ECs) have a supply of 3,022, adding the overall home supply number to 53,696 units with planning approvals.

Also read: Over 50,000 homes in the supply pipeline until 2022

Sun added that in the same period, developers moved 2,350 new homes, excluding ECs, which is 27.9% QoQ higher. 4,188 new homes were sold in H1 2019, which is6.1% greater than the 3,947 units sold in H1 2018.

“The robust sales indicate that demand for private homes is still healthy and the market is gradually recovering one year after the cooling measures. The secondary market has also seen a revival of buying interest with more homes being sold last quarter,” she continued.

URA further stated that developers expect around 4,398 units to be sold in H2 whilst another 5,265 units will be completed in 2020.

The stock of completed private residential units went up to 863 units Q2, as compared with the increase of 953 units in the previous quarter. As a result, the vacancy rate of completed private residential units rose 6.4% as at the end of Q2 from 6.3% in Q1. Vacancy rates of completed homes in CCR, RCR and OCR were 7.8%, 6.4% and 5.7% respectively.

Advertise

Advertise