Photo from Savills

Photo from Savills

Singapore's capital value growth weakens amidst new launch scarcity

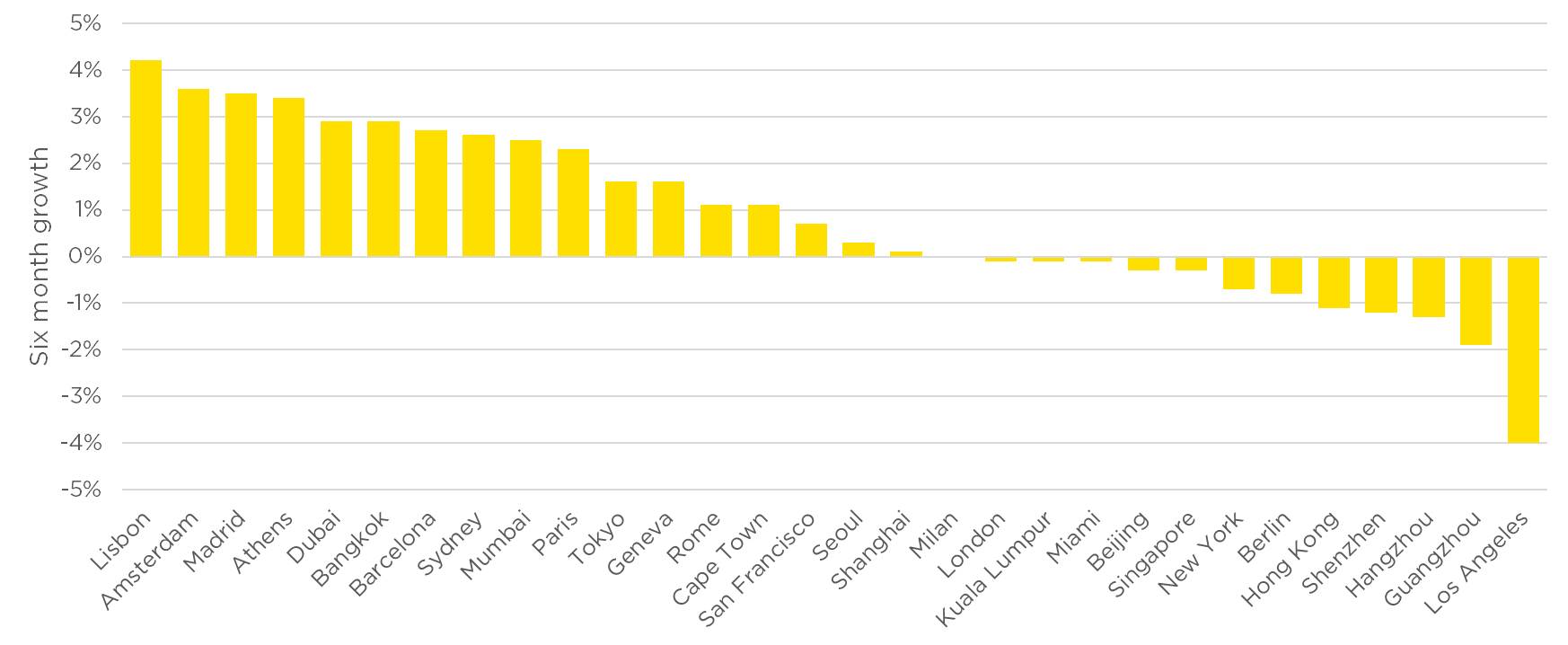

It ranked 23rd globally for strongest residential capital growth.

Singapore ranked 23rd globally among cities with the strongest capital value growth for residential properties.

According to Savills, Singapore's decline in the Prime Residential Index: World Cities - Capital Values is negligible, as prices have remained largely unchanged.

Alan Cheong, executive director of Research & Consultancy at Savills Singapore, emphasised that high-end private residential property prices are trending downward due to a lack of new launches, which previously set benchmark prices to boost the market.

The substantial Additional Buyers Stamp Duty (ABSD) also kept non-permanent resident foreigners away from the market.

In Q2, however, Cheong said Singapore saw more foreign participation in the market.

“Although the worst may be behind us, it may still take some quarters for the increasing foreign content to make a significant positive influence on the market," Cheong said.

"The sub-segment of foreign demand to watch is the Permanent Residency (PR) class. Although PRs pay ABSD, it is only 5% and significantly lower than the 60% levied on non-PRs. Therefore, we expect more PRs committing to buying private residential properties in the coming quarters," Cheong added.

Meahwuo,e George Tan, managing director of Livethere Residential, Savills Singapore, expects sales to increase following the supply ramp-up in H2 2024.

“Interest rates may also drop. With that, prices may moderate and we can anticipate some growth in the market," Tan added.

Advertise

Advertise