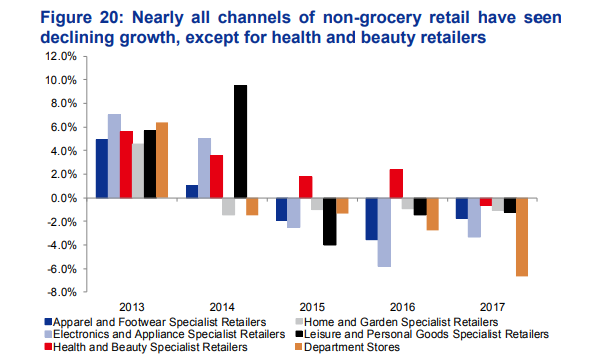

Chart of the Day: Health and beauty stores buck non-grocery decline trend

Their five-year sales from 2012 to 2017 grew 2.5%.

This chart from CGS-CIMB shows that sluggish sales growth trends were seen for all other major non-grocery segments, with apparel and footwear (A&F) retailers seeing -0.3% compounded sales in 2012-2017, and electronics and appliance retailers seeing stagnant sales.

However, health and beauty (H&B) retailers seemed to be the exception to the weakness, with 2012-17 sales CAGR of 2.5%. CGS-CIMB analyst Cezzane See commented, "The weak economy and relatively-low price points of beauty products led to increased purchases as consumers sought small but attainable gratification."

See noted that beauty retailers in Singapore have been successful in providing “retail-tainment” to consumers. "Stores like Sephora have designed stores and added services (beauty bars, photo booths, virtual artists) to entice customers to stay and try products before purchasing," she added.

Department stores (DS), electronics and appliance (E&A) retailers, leisure and personal (L&P) goods retailers, and A&F retailers accounted for the bulk of Singapore’s non-grocery retailers’ and speciality retailers’ market value.

Euromonitor estimates non-grocery retailers to see negative five-year sales of 1.2% over 2017 to 2022. E&A retailers are forecast to shed the largest market value, followed by A&F specialists. Oppositely, sales of H&B specialists, variety stores, and warehouse clubs are expected to grow.

Moreover, only H&B, home and garden specialist retailers, and variety stores are likely to see the number of stores increase in the next five years.

Advertise

Advertise