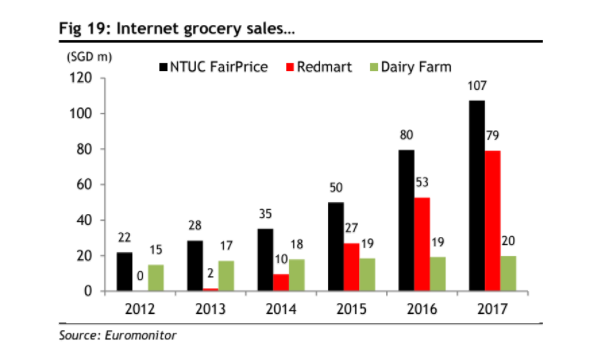

Chart of the Day: Online grocery sales growth dipped to 35% in 2017

New online groceries can't break into the dominance of supermarkets.

This chart from Maybank Kim Eng shows that the total growth of online grocery sales in Singapore has dropped from 56% in 2016 to 35% in 2017.

The decline could be attributed to the slower growth of RedMart's sales from 95% in 2016 to 50% in 2017. The online grocery retailers' total sales grew from $53m to $79m in one year.

The growth of FairPrice's online sales also dropped from 59% in 2016 to 35% in 2017. On the upside, total sales breached the $100m mark in 2016 at $107m, higher than $80m in 2016.

According to Maybank KE analyst John Cheong, "FairPrice’s first-mover advantage and market dominance have limited the room for disruptions by new entrants for the incumbents."

Also read: Chart of the Day: Sheng Siong and FairPrice are eating up the supermarket pie

Dairy Farm's online sales have been the slowest. Growth remained at 4% in 2016 to 2017. Its online sales have been declining for five years. Maybank KE reported that its highest growth rate was at 14% in 2012.

According to Maybank KE, these online groceries have not been able to defeat physical supermarkets due to the following: growing demand for hand-picked fresh food, rising restaurant prices, price sensitivity of mass market shoppers, and the growing response of the supermarkets themselves.

"Click-&-collect or click-&-deliver services have been launched by almost every major supermarket brand, though contributions are minuscule at 1% of their revenue," said Cheong.

"From what we can detect, the impact of online retailing is probably felt the most in bulk purchases, as bulk purchases can be heavy to lug home from physical stores. Examples are packaged drinks and personal-care & home-care products," he added.

Advertise

Advertise