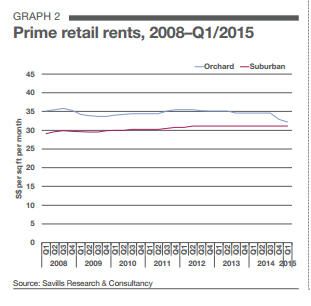

Chart of the Day: Orchard prime retail rents dip as tourists and retailers dwindle

Despite positive retail sales.

Orchard Road continues to feel the pinch of fewer tourists and retailers opting to go to suburban malls.

According to a report by Savills, despite the positive retail sales performance in Q1/2015, prime retail rents in Orchard Road dipped 2.0% QoQ to S$32.2 per sq ft per month. This could be attributed to the fall in tourist numbers as tourists form an important target segment for the Orchard shopping belt.

On the other hand, suburban malls held firm at S$31.1 per sq ft per month, as more retailers are seen moving out from the Orchard belt to the suburbs where the consistent and large catchment of shoppers throughout the week is the main draw.

Savills adds that the chase for footfall will drive up the demand for suburban mall space and result in a decreased demand for Orchard Road retail space, thus gradually closing the gap between their respective rents. As retailers are currently not generating sufficient sales to overcome rising labour costs, overall retail rents are facing tenant resistance which will probably continue over the next few quarters.

In Q1/2015, the island-wide vacancy rate inched up 1.0 percentage point (ppt) to 6.8%. With the completion of Capitol Piazza and phases of Suntec City Mall’s additions and alterations (A&A) works, the vacancy rate in the Downtown Core planning area increased by 4.2 ppts to 11.7% while that in the Orchard planning area was marginally up 1.6 ppts to 7.2%.

Advertise

Advertise