Chart of the Day: Sharply lower rents await struggling retail REITs in 2016

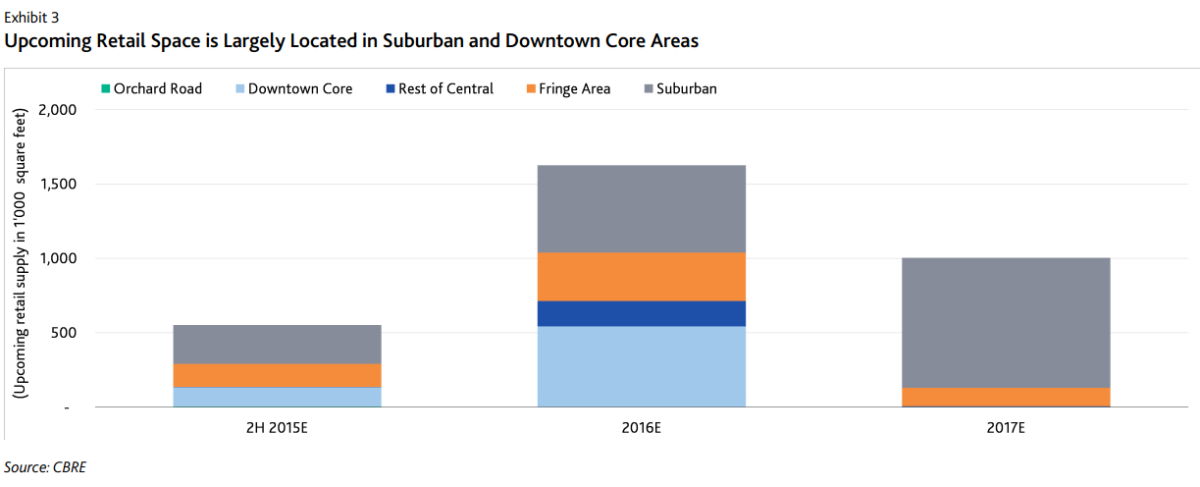

3.2 million sq ft of space will flood the market.

Soft retail spending and a massive supply of commercial space will pressure retail REITs into lowering rents in 2016 and 2017.

According to a report by Moody's, some 3.2 million square feet of retail space are due to be completed from the second half of 2016 until 2017. Bulk of this space will be located in the suburban and downtown core areas.

"We expect retail occupancy and rental rates to be under pressure over the next 12-18 months as a challenging operating environment weighs on leasing demand while new supply continues to come on-stream," Moody's said.

Suburban retail occupancy will be more resilient, as the pipeline of retail space is spread across different neighborhoods and will mostly cater to the non-discretionary spending needs of growing

residential areas.

However, occupancy and rents in the prime downtown core area will be under great pressure as most tenants there cater to discretionary spending.

"We expect the take-up of new retail space to be slow, as retailers grapple with soft consumer demand, higher operating costs, a tight labor market and increasing competition from online retailers. The retail market will likely see further closures and consolidation as retailers focus on improving store efficiency," the report added.

Advertise

Advertise