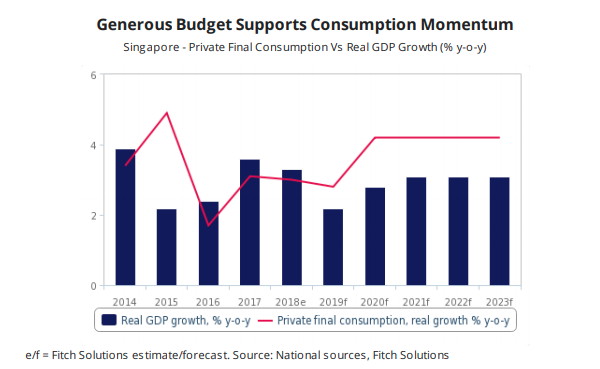

Private consumption to hit 2.8% amidst Budget 2019 boosts

It is expected to outpace the country’s economic growth at 2.2%.

Singapore's private consumption is forecasted to pick up to 2.8% YoY in 2019, outpacing the country's economic growth of 2.2% YoY, as the fiscal stimulus announced in the 2019 Budget will provide a boost to domestic demand, according to a report by Fitch Solutions.

The government released an expansionary budget in February, which included significant support for the Merdeka Generation (born in the 1950s) with a $6.1b budget set aside for healthcare and outpatient care. The government also set aside a $200m Bicentennial Community Fund and a $1.1b Bicentennial bonus for Singaporeans justified by the accumulation of fiscal surpluses during the government’s current term, which began in 2015.

Also read: 500,000 seniors to receive Merdeka Generation Package letters by end-April

“Moreover, families with children, and lower-income workers will continue to benefit from Singapore’s effort to ‘nurture [the] young’ and ‘expand opportunities for people’,” Fitch Solutions highlighted, adding that lower-income workers can expect to receive a $300 goods and services tax (GST) voucher and a “‘Workfare Bicentennial Bonus”’ cash payment (10% bonus for work done in 2018), which the government expects will benefit 1.4 million Singaporeans.

Fitch Solutions also noted that the contained inflation will lend support to consumption. Headline inflation in Singapore reached 0.5% YoY in February 2019, maintaining the same pace of growth as in February 2018.

“Although we expect headline inflation to rise in 2019 to 1.3% from 0.4% in 2018, we think that the combination of an appreciating SGD nominal effective exchange rate (NEER), which will help in capping imported inflation, a weaker growth outlook, and stable oil price should cap inflationary pressures and keep the Monetary Authority of Singapore (MAS) on hold,” the firm explained.

That said, slowing productivity in Singapore could be a cause for concern despite the city-state having a relatively tight labour market. Productivity growth cooled to 0.6% YoY in Q4 2018, down from 3.9% in Q4 2017.

Unemployment levels are expected to remain low in 2019 at 2.2% and remain stable at this level throughout Fitch Solutions’ forecast period to 2023.

“Wage growth has been on an uptrend with the median monthly income rising by 4.8% in 2018, up from 4.3% in 2017. This comes on the back of a growing share of consumers working in the higher-paying services sector, which accounts for 73.6% of employment in 2017, up from 70.1% in 2013,” the firm added.

Fitch Solutions noted that there may be little upside for retail sales growth as the cash handouts and fiscal support announced in the 2019 budget will not take effect until the later half of 2019, and the effects are likely to only be felt the month after.

They highlighted how, in 2018, cash handouts were given out to consumers in November - December 2018, but this reflected in January 2019 when retail sales picked up by 7.6% YoY.

“We do however note that this period coincides with the Chinese New Year festive season and has historically been a time period when consumers make the bulk of their purchases,” Fitch Solutions added.

Advertise

Advertise