HDB resale

Housing & Development Board (HDB) resale refer to rent-to-own HDB flats. Buying an HDB resale flat means transferring ownership from a previous owner.

See below for HDB resale price articles or click here for HDB resale price FAQs.

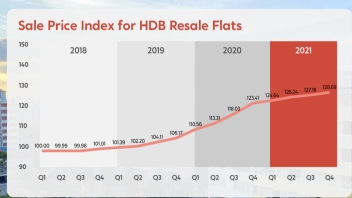

Chart of the day: HDB resale flats price index grows 3.4% in Q4 2021

Chart of the day: HDB resale flats price index grows 3.4% in Q4 2021

HDB resale prices up 1.1% MoM in January 2022

HDB resale prices up 1.3% MoM in November

HDB resale volume for 2021 could hit 29,000: analyst

HDB resale prices at an all-time high after 2.9% increase in Q3

HDB resale prices up 13.8% YoY in September

Investors hungry for HDB resales during hungry ghost month

Resale market in SG returns after 2-year hiatus: Report

HDB resale prices jump 13.2% in July amidst ‘price bidding wars’

Million-dollar flat transactions reach record high by July 2021

HDB resale prices climb for the 5th consecutive quarter by 3.0%

HDB resale prices climb for the 12th straight month in June

HDB resale FAQ

Can I use all my CPF to buy resale HDB?

Yes, you can use all the CPF to buy resale HDB, and no at the same time. For older flats, the younger borrower may not be able to use the whole CPF amount. There will be limitations on the CPF usage if it is an older flat.

See more information in this article.

Is resale HDB a good investment?

For some, resale HDB is very much a good investment because of the lack of supply. There are also experts who say that a resale HDB flat is for owner occupation and should not be viewed as an investment.

See more information in this article.

What happens to HDB after 99 years?

It will return to HDB after 99 years.

See more information in this article.

How much do you pay upfront for resale HDB?

The maximum deposit to pay upfront for resale HDB is $5000. Anything that is beyond the valuation has to be paid in cash. About 85% is loan covered and about 15% needs to be paid upfront.

See more information in this article.

How do you calculate the cost of a resale flat?

The valuation is a very integral part to calculate the cost of a resale flat. The valuation depends on the HDB assigned valuer.

See more information in this article.

How much CPF do I need for resale?

The CPF needed for resale depends on the price of the house. Given he can take a loan of about 85% based on his income capacity, he needs to standby 15% of the valuation.

See more information in this article.

Can I use CPF to buy a house after 55?

Yes, you can reserve all or part of your OA savings before you turn 55 to buy a house after 55.

See more information in this article.

Which is better, BTO or resale?

The matter of which is better between BTO and resale depends whether you need a home urgently or you can afford to wait. There are grants available to help buyers buy a resale flat. Depending on the amount of grants, this can potentially make the price of a resale flat similar to a BTO flat and make a resale flat more appealing.

See more information in this article.

How much cheaper is BTO vs resale?

A BTO, given generous subsidies by the Government which can range from 15% to 35%, is much cheaper vs resale. It also depends on the district location. BTO can be cheaper by 100,000 to 200,000 vs resale.

See more information in this article.

How many times can I buy resale HDB?

There is no limit set to how many times one can buy resale HDB. That means you can buy resale HDB as many times as possible but the waiting time right now is five years.

See more information in this article.

Can resale flat be rented out?

Yes, resale flats can be rented out after five years of physical occupation and ownership, which is the minimum occupation period (MOP).

See more information in this article.

Can I sell my HDB flat back to HDB?

You are encouraged to sell your HDB flat back to the resale market. You can sell HDB flat back to HDB in certain scenarios: financial reasons, if the owner is no longer a Singapore citizen, etc. HDB will take it at a lesser price.

See more information in this article.

Advertise

Advertise