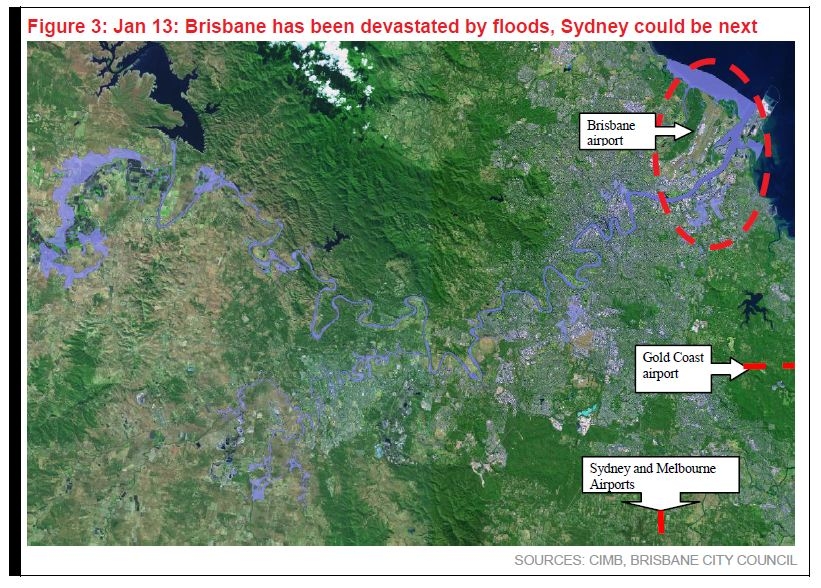

Here's an aerial shot of the flood threatening Tiger Australia's operations

75% of its routes are affected.

According to CIMB, Australia has been hit by a wild weather system, in a re-enactment of Dec 10, this time by Cyclone Oswald. Brisbane is bracing for floods and Sydney is likely to be next.

Flight cancellations, delays, complaints and refunds will follow. Tiger has cancelled flights to and from Melbourne, Sydney, Brisbane and the Gold Coast. Losses could widen in the next quarter.

Here's more from CIMB:

We expect stock weakness in the near term, though we remain longer-term Neutral, in view of a potential divestment of its loss-making Australian operations.

We raise our FY13 loss estimate by 16% to account for Cyclone Oswald, but keep FY14-15 EPS and SOP target price intact.

Brisbane is bracing for floods in the aftermath of Cyclone Oswald’s visit and Sydney could be next. Tiger Australia cancelled five flights on 27-28 Jan.

It also warned of further delays and cancellations. To appease frustrated consumers, it is offering reschedules and refunds for affected flights.

While weather is out of Tiger Australia’s control, this will still create a major setback for its recovery.

The major sectors affected form 75% of its routes. In the aftermath of the Dec 10 floods, Tiger Australia turned in an operating loss of S$8.6m from a S$6m profit the previous quarter.

We raise our FY13 loss estimate by 16.3% to account for the near-term damage from Cyclone Oswald. Apart from immediate loss of sales, Tiger will suffer from knock-on cancellations and delays in the coming weeks, reschedules and refunds.

We deem this a very important period for the company. Effective customer management is crucial for improving its branding in Australia, one of the requisites for lifting demand.

We expect near-term price weakness. However, any effective crisis management could reinforce Tiger’s longer-term recovery. In addition, we see some price support from a potential divestment of its loss-making Australian operations.

Advertise

Advertise