CBD Grade A office transactions down 15.4% in Q4

Buying activity went sour despite the healthy demand for office spaces.

CBD Grade A office leasing transactions fell 15.4% YoY and 8% QoQ to 1,176 deals in Q4 amidst limited supply and seasonal factors such as the year-end holidays, according to a Savills report.

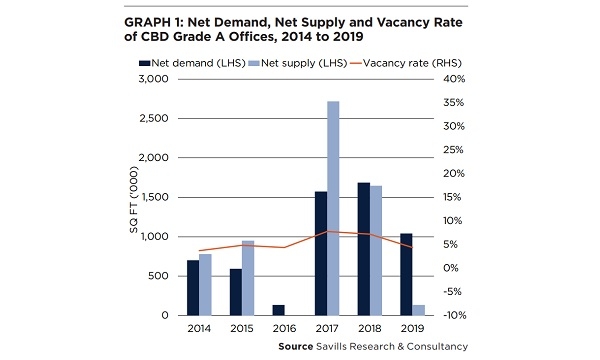

Likewise, vacancy rate dipped 2.9 ppt YoY to 4.4% at year-end. Net new supply was low at 34,200 sqft during the same period. “Compared with the 4.4% recorded in Q4/2016, this indicates that the bulky new supply which has entered the market since Q1/2017 has finally been absorbed,” said Alan Cheong, executive director for research at Savills.

Furthermore, the strong demand for CBD Grade A offices wasn’t enough to counter the decline in leasing transactions as well. Net demand stood at about 385,000 sqft, which is mainly driven by tenants’ move into Frasers Tower on Cecil Street and the newly completed Funan office towers on North Bridge Road.

The report noted that the latter injected about 214,000 sqft of new supply into the Grade A office market in Q4. For the whole of 2019, the net take-up of CBD Grade A offices amounted to 1.04 million sqft.

However, the good news was that the pre-commitment levels in upcoming projects have seen some improvement in the last few months. For example, Savills cited co-working provider The Great Room, which will occupy 37,000 sqft of office space in Afro-Asia i-Mark at 63 Robinson Road through a revenue-sharing deal with the landlord.

This deal is said to have brought the pre-commitment rate to 26% of the total net lettable area (NLA) of 140,000 sqft. A short distance down the road 79 Robinson Road, owned by CapitaLand, also secured some more tenants. CapitaLand’s Bridge+ will take up 56,000 sqft to set up a fintech hub with flexi-desks, dedicated fixed desks and private suites.

“It was confirmed that flexible workplace remained the anchor or sub-anchor tenant in upcoming projects and expansion of these kinds of facilities was one of the key themes for 2019’s office leasing market in Singapore,” Cheong stated.

The most notable deal was the $340m acquisition of Robinson Centre by a private fund managed by ARA Asset Management. Outside the CBD, there were two small office blocks transacted - Fragrance Group’s $28.8m divestment of its five-storey freehold namesake building at Changi Road to Pergas Investment Holdings and the $79.3m acquisition of KH Kea Building on North Bridge Road by UOL Group.

In 2019, the report said that at least 20 co-working facilities opened, taking up a total of about 765,000 sqft of space island-wide. Coming to 2020, Cheong projects the expansion to continue at a much slower pace, whilst consolidation amongst some operators can also be expected.

Advertise

Advertise