Flexible workspace operators move to hotels and malls as CBD gets crowded

Over 80% of flexible workspaces are already located in CBD.

Flexible workspaces may continue to expand to retail and hotel spaces on top of decentralising to fringe areas, as vacancy in the central business district tightens, according to Colliers Research.

The expansion to retail and hotel spaces was observed as a key trend in the industry after Justco moved into a 60,000 sq ft-wide location in Marina Square mall in Q2 2018. Launched August, The Great Room was the first to open in a six-star hotel, occupying 15,000 sq ft of space on level two of the restored Raffles Hotel Singapore.

IWG’s Spaces also took up 35,000 sq ft for both four floors of One Raffles Place launched in July and two floors of TripleOne Somerset in May.

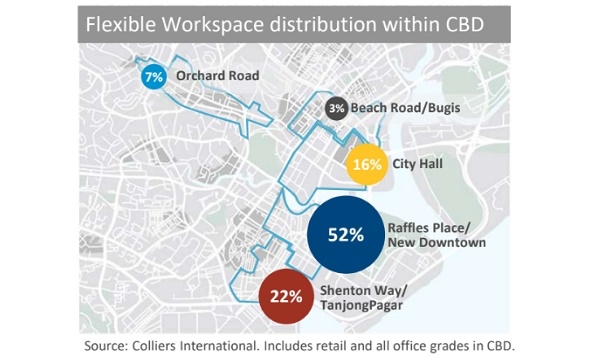

Operators may also increasingly look for alternative locations outside the city as the central business district (CBD) already contains 83% of the flexible workspace stock with 52% concentrated in the Raffles Place/New Downtown micro-market. Only 12% are located in the city fringe and 5% in suburban areas, suggesting significant room for growth.

Amidst heightened competition in the flex workspace segment, industry consolidation is also expected to continue through collaboration between landlords and operators, mergers and acquisitions, or international operators entering the market. Colliers noted that there were a number of players that closed up shop, with most closures coming from small-sized, single-space operators with an average floor space of 7,500 sq ft, compared to that of currently operating centres at 17,000 sq ft and the average NLA of upcoming supply at 42,000 sq ft.

The top seven operators in Singapore command 65% of the market, with over half of the pie occupied three players with significant footprint, namely WeWork, IWG and JustGroup.

These players are riding on the rapid pace of growth in the flex workspace segment with net lettable area growing at a CAGR of 36% over the last three years. Amidst heated demand, the sector is tipped to grow by 24% by end-2019 which will slow slightly to 15% by 2020 due to higher base and tight vacancy rates.

Advertise

Advertise