Chart of the Day: Demand for office space remains healthy

In December 2012 alone, three major investment deals were closed.

Colliers International Singapore reported:

After the momentary breather in 3Q 2012, office sales activities picked up pace in 4Q 2012, on the back of a rush of office en bloc investment deals sealed before the end of the year.

In December 2012, the market saw the conclusion of three major investment deals – including Mapletree Commercial Trust’s acquisition of Mapletree Anson for S$680 million; DBS Group Holding’s purchase of a 30-per-cent stake in Marina Bay Financial Centre Tower 3 for S$1.035 billion; and United Engineers’ acquisition of 79 Anson Road for S$410 million.

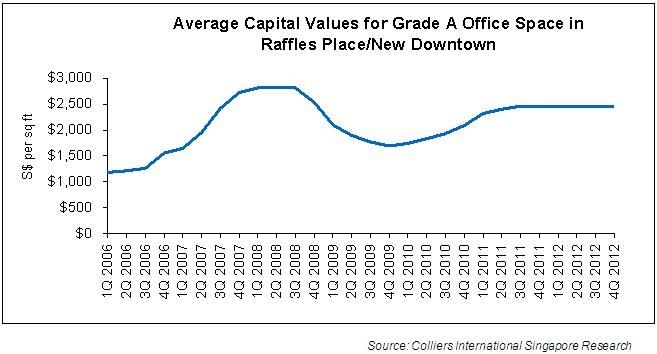

Underpinned by sanguine investors’ sentiments, the average capital value of Grade A office space in the Raffles Place/New Downtown micro-market held firm for the second consecutive quarter at S$2,447 per sq ft in 4Q 2012. Consequently, the average capital value for the whole year dropped by a mere 0.5 per cent from S$2,459 per sq ft recorded in 4Q 2011.

Advertise

Advertise