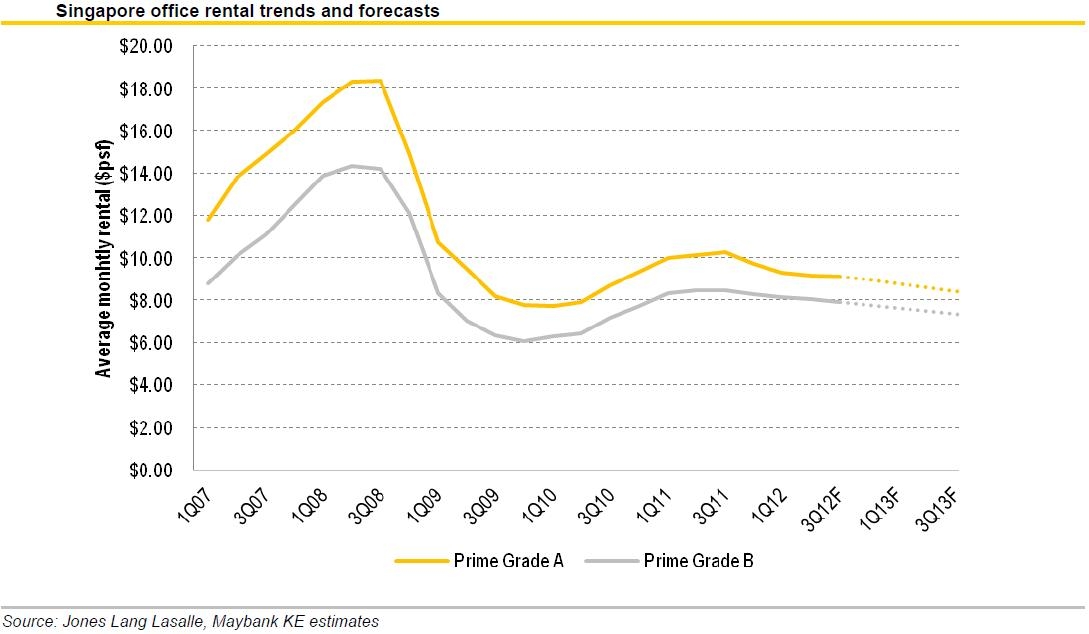

Chart of the Day: Grade A rents fall 9.4%

Average was at S$9.20 psf per month in 2Q12.

Maybank Kim Eng reported:

Grade A rents down ~10% on-year. 12 months ago, we correctly identified the peak for office rents and expected Grade A and Grade B office rents to head for a 10% and 20% correction respectively in 2012.

We were spot-on for Grade A, where rents have already fallen by 9.4% to average at SGD9.20 psf pm in 2Q12. Grade B rents were however surprisingly resilient, correcting by a milder 5.3% YoY.

Lingering uncertainties affecting business expectations. The pace of rental decline may have moderated somewhat in the last quarter, but we do not think it has found a bottom.

The global economy remains anaemic, with major concerns surrounding the future of the Eurozone and questions being asked about the true state of China’s economic health.

Singapore, being such an open economy, cannot be immune to these market uncertainties, and business sentiments have been affected.

According to figures from the Department of Statistics, general business expectations in Singapore deteriorated in 2Q12, particularly for the financial sector. Our Chief Economist, Suhaimi Ilias, has a Singapore real GDP growth forecast of 2.5-3% for 2013.

Advertise

Advertise