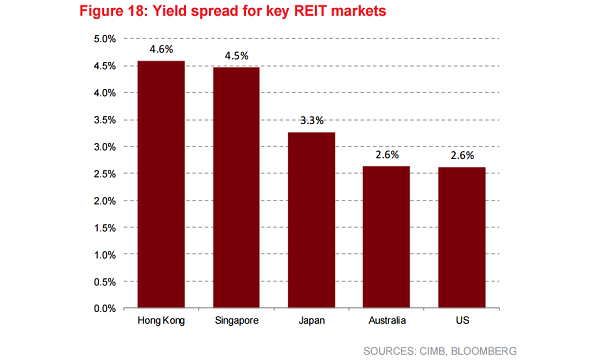

Chart of the day: Here’s solid proof that Singapore has one of the cheapest REIT markets

The sector is trading at 6.3% dividend yield.

The city-state is still cheap in terms of valuations from a yield spread perspective, according to analysts.

According to a report by CIMB, the current valuations are not excessive weighing the top-down hunt for yield against bottom-up lacklustre fundamentals.

“Furthermore, S-REITs are still trading at a 450bp spread vs. the 10-year bond yield, c.75bp higher than the average 370bp. Compared to the other key REIT markets, S-REITs is also one of the cheapest,” the report noted.

Meanwhile, analysts added that industrials may now be the most preferred REIT subsector.

“We project industrial to record an average 1.1% yoy increase in 12-month DPU, followed by +0.7% yoy for retail, -0.1% yoy for office and -10.1% yoy for hospitality,” the report added.

Advertise

Advertise