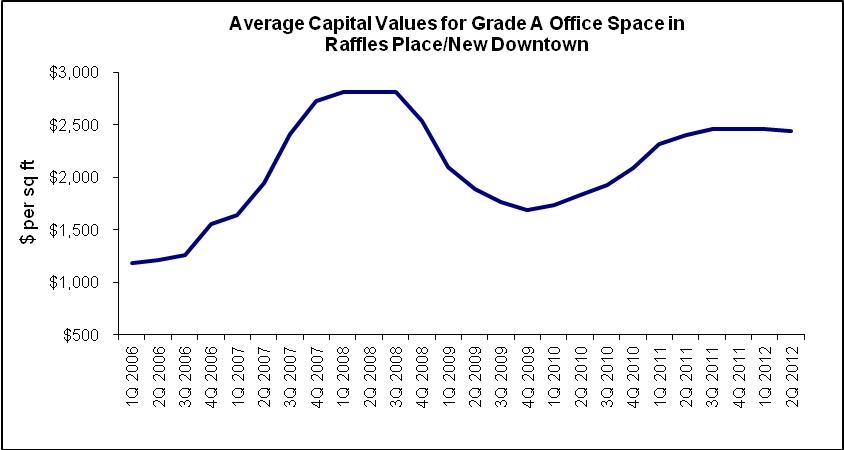

Chart of the Day: Office premises capital values show signs of softening

Capital values succumbed to the pressure from the continued easing in office rents in 2Q to record its first correction in 2.5 years, says Colliers International.

Colliers International reported:

The average capital values of Grade A office space in the Raffles Place/New Downtown micro-market softened by a marginal 0.5 per cent – from the S$2,459 per sq ft recorded in 1Q 2012 to S$2,447 per sq ft by end June 2012.

The soft leasing market and the continued easing of rents for the third consecutive quarter since 4Q 2011 – on the back of an increasingly-challenging global economic environment – have resulted in increased caution and lower price expectations among investors.

Nonetheless, driven by the low interest rate environment and continued availability of new strata supply, the office sector enjoyed sustained interest in the sales market during the quarter.

For example, 60 per cent of the 56 office units that were released for sale at Oxley Tower on Robinson Road were snapped up within the first few days of its launch in 2Q 2012, at prices ranging from S$2,800 per sq ft to S$3,490 per sq ft. EON Shenton also reportedly saw more than 30 office units sold out of the 50 units released during its preview at prices between S$2,150 per sq ft and S$3,000 per sq ft.

Meanwhile, en bloc sale of strata office units was also brisk in 2Q 2012.

In April 2012, 51 strata office units in Parkway Centre at Marine Parade Central were collectively sold for S$53.4 million, or about S$1,043 per sq ft. In the following month, 66 strata office units in Burlington Square at Bencoolen Street were sold for S$89.3 million or S$1,318 per sq ft.

The keen interest seen in the strata office market was underpinned by the inherent investment potential of such properties – not only are they, particularly that of quality and modern ones, limited in stock, strata office space also enjoy comparatively-high occupancy rates.

Advertise

Advertise