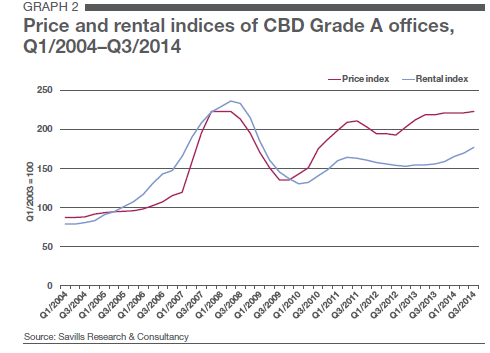

Chart of the Day: See the upswing in CBD Grade A office rents in the run up to 2016’s supply deluge

Average transacted rents in 3Q increased by $0.41 psf.

Overall rental growth for CBD Grade A offices surged 4.4% quarter-on-quarter (QoQ) in Q3/2014, after experiencing a slower growth of 2.3% last quarter.

According to a report by Savills, CBD Grade A office rents will continue their upward march into Q4/2014. Thereafter, for 2015, they may stabilise due to factors such as uncertainties in the global and regional economies and landlords adjusting rates in anticipation of the deluge of supply in 2016.

Savills adds that the decanting of tenants from Equity Plaza, many of whom take up only smaller spaces, may support older Grade A office building rents, particularly those with units that are less than 5,000 sq ft in size.

Capital values for CBD Grade A buildings should hold steady well into 2015 as only a few, if any, transactions of entire buildings are expected due to their large ticket size and also the current environment of low initial yields.

Advertise

Advertise