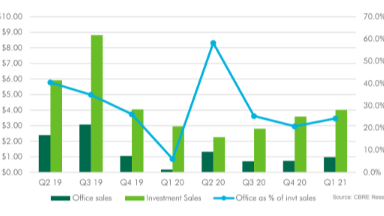

Chart of the Day: Singapore real estate investment volumes jump in Q1 2021

Office transactions have picked up to $971.81m or 24.2% of total investment sales.

This chart from CBRE shows that real estate investment volumes in Singapore have strongly picked-up in the last few quarters, jumping from $2.264b in Q2 2020 to $4.009b in Q1 2021.

Of which, office transactions have increased from a low $177.73m in 1Q20, or 6% of total investment sales, to $971.81m in 1Q21 or 24.2% of total investment sales. This is likely driven by an anticipated recovery in rents and the redevelopment potential of some of these assets.

Strong office transaction values were recorded in 2019 and 2020 despite ongoing debate about long-term office demand amidst flexible work arrangements and the future of work itself. The continued downward revisions to commercial development charges, especially to sectors in the central region in both September 2020 and March 2021, will further improve the economics of redevelopment under these schemes, the report said.

Furthermore , the government has not been releasing sites for commercial development, which push developers to turn to the private market for redevelopment opportunities.

To conclude, the resurgence in office sales highlights the stability and “safe haven” reputation of Singapore which attracts global firms to set up and expand their bases here, CBRE said. This provides support for office space demand and gives investors long-term confidence in the local office sector.

Advertise

Advertise