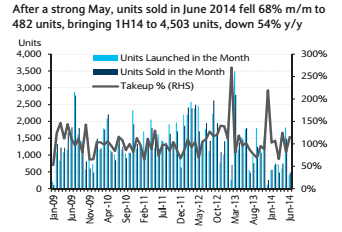

Chart of the Day: Weak developer sales suggest advent of Hungry Ghost Month

Two new launches sold a disappointing 8% of total units.

Developer sales are seeing a slowdown, and the lacklustre activity may well carry on into August, as the traditional quiet period of the Ghost Month kicks in on 27 July.

According to Barclays Research, there is an oversupply of private housing properties and prices are expected to fall 20% by 2015 in view of market expectations for interest rates to rise coinciding with peak supply and Barclays' assumption that the vacancy rate could reach a record 10% by 2016.

Here's more from Barclays:

Private home sales plunged 68% m/m to 482 units on only two new launches: 1) The Crest at Prince Charles Crescent by Wing Tai sold only 35 units, or 7% of the total of 469 units, at a median price of S$1,682psf and 2) the Trilive at Tampines Road by Roxy-Pacific sold 19 units, or 9% of the total 222 units, at a median price of S$1,605psf. Sales at the projects launched in May, which did well in May, all slowed down significantly in June: The Coco Palms, Commonwealth Towers and Kallang Riverside, which sold 590, 275 and 96 units in May, respectively, only sold 55, 24 and 6 units in June.

CCR’s sales rose 12% to 46 units but remained lacklustre on no new launches and abundant completed but unsold supply. The highest median price in June was at The Laurels at Cairnhill for which the last unit was sold at S$2,810psf.

Sale for June brought the sales for 1H14 to 4,503 units, down 54% from 9,841 units for 1H13. We estimate that The Crest was priced 7% below its expected pricing level of S$1,800psf, but we note that it still did not do well. Certain projects, such as The Panorama,for which selling prices have been brought down by about 10% since its launch in January, also continued to see tepid sales with the total take-up at 29%. We believe this shows the severity of the slowdown since the TDSR framework was imposed in June 2013. Based on the runrate, we estimate that private new home sales could be headed for a full-year take-up of 9,000 units for 2014, which would be a decline of 40% from 14,948 units for 2013 and a drop of 59% from 22,197 units for 2012.

Advertise

Advertise