Photo from Freepik

Photo from Freepik

Expert cuts shophouse sales forecast to $700m-$800m for 2024

The previous projection was $1.1b-$1.2b.

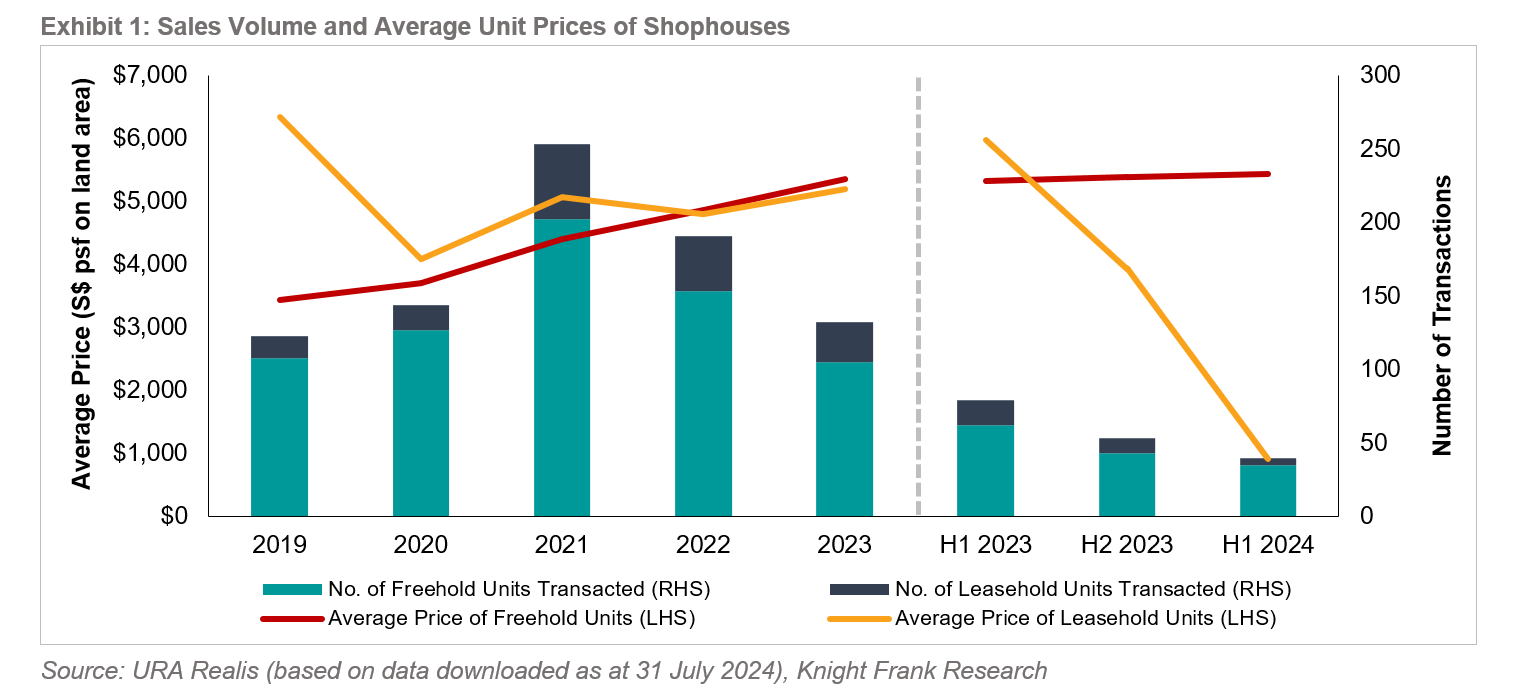

The shophouse market is projected to have a reduced sales volume for 2024 compared to earlier forecasts, as market activity has slowed.

Estimates from Knight Frank show that the market will likely record a sales volume of $700m to $800m in 2024, down from the earlier projection of $1.1b to $1.2b.

In H1, the sales volume of the market dropped 17.3% YoY to $354.0m. During the period, the number of transactions dropped by 24.5% YoY to 4-0 units.

Knight Frank also reported a 56.5% YoY drop in the average unit price of shophouses, falling to $2,225 psf on land.

“The institutional sale of the leasehold The Rail Mall for S$78.5m or $744 psf on land by Paragon REIT in June, comprising a land area of 105,563 sf, inclusive of car park lots, that led to a substantial decline in the average unit price,” the expert explained.

Freehold shophouses led sales in the first half of the year, making up 35 of the 40 units sold. However, compared to last year, freehold shophouse transactions decreased by 18.6%, with the total transaction value dropping to $252.2m.

Even with the muted shophouse market, Knight Frank said boutique developers will persist in scouting older shophouses for medium-term refurbishment projects.

“Typically, ticket sizes of between $5m to $6m per typical conserved shophouse fall within the reach of such asset enhancers. By adding value to aged conservation properties in historical neighbourhoods, better occupiers are introduced, income streams grow, and the assets appreciate. Eventually, entire neighbourhoods are gentrified,” Knight Frank added.

Advertise

Advertise