Photo by Goh Rhy Yan on Unsplash

Photo by Goh Rhy Yan on Unsplash

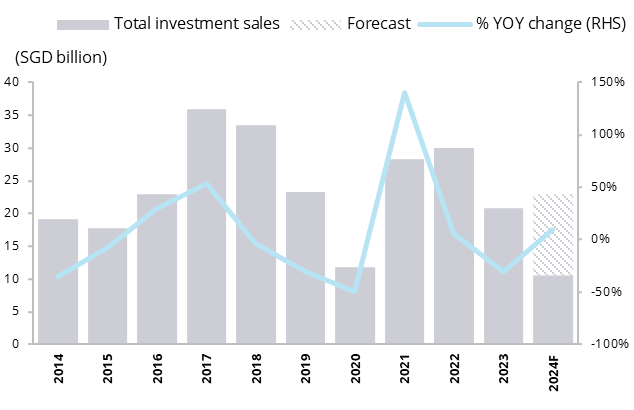

GLS tenders boost property investments to $6.5b in Q2

Investments rose 64.1% QoQ and 71.1% YoY.

Thanks to several large GLS tenders, Singapore saw its property investment volume rise to $6.5B, up 64.1% QoQ and 71.1% YoY in Q2 2024.

In Q2, GLS tenders accounted for 48.6% or $3.2b of investments.

Without the GLS deals, this quarter's investment volume would have only increased by 23.2% QoQ and 7.0% YoY, supported by the Office (37.0%), Residential (27.0%), and Mixed (14.6%) sectors.

“The pickup in transaction volumes during the quarter signals the confidence investors have in the Singapore real estate market and its assets, though significant gaps in price expectations between buyer and seller are still inhibiting some deals” Colliers said.

“As demonstrated by some of the transactions this quarter, investors are looking to redevelopment opportunities to provide higher returns in this low-yield environment. It helps that this strategy does not add too much risk in a stable market like Singapore. Consequently, there appears to be a ready pool of buyers and investors for assets with redevelopment potential,” Colliers added.

In the upcoming months, Colliers anticipates an increase in divestments, especially for REITs. The expert also predicts that these divestments in Singapore will benefit shareholders, given that exit yields are expected to stay below the borrowing costs for floating-rate debt.

“As such, more REITs and institutional funds will look to recycle, redevelop and optimise their portfolios with higher-yielding assets,” Colliers said.

Advertise

Advertise