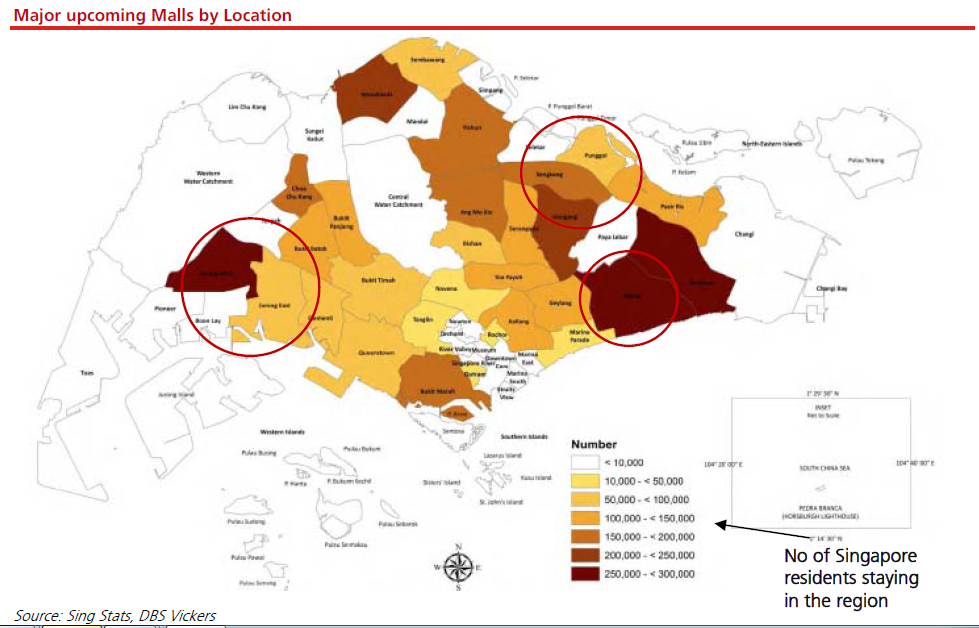

Heat map: Increasing working population to support new malls

6 major upcoming malls are located in high-growth residential areas.

According to DBS Group, 55% of new supply is expected to be in the suburban area which are expected to be supported by increase number of residents and working poulation.

DBS notes that suburban rents may increase by 2-3% next year, supported by healthy pre-commitments.

Here's more from DBS:

Supply in the next two years will swing towards the suburban areas. We estimate that 5.0 msf of retail space is expected to be completed between 4Q12 and 2016. Of that, 56% or 2.7 msf is located in the Outside Central Region, while 17% and 13% will be located in the City Fringe and Downtown areas, respectively. The remaining 9% and 5%will be at Orchard and Rest of Central Area, respectively

In OCR, about 75% of the supply, expected to enter the market over the next four years, will come from six projects which are mainly located in (i) Jurong Gateway, which is the upcoming regional hub, (ii) Bedok, a mature residential estate (iii) Sengkang and Punggol, which are high-growth residential areas . More importantly, these malls are generally near the MRT stations and would usually attract good leasing interest. They are owned by experienced and wellestablished landlords who have large tenant bases. The remaining 20% are small neighborhood malls or smaller supporting retail facilities for larger developments.

In addition, these malls are located in highly populated area or fast growing population planning areas. Bedok Mall is located in the Bedok Planning area which is the most populated with 295, 000 Singapore residents. Census information from 2000 to 2012 showed that Sengkang

(+116,500), Punggol (+ 74,700) and Jurong West (+67,150) were some of the highest resident population growth areas.

New malls will be supported by increase number of residents and working population. We believe that the strong population trends for these areas should continue with the growing number of new housing in these estates. In particular, we note that between 2009 and 2010 >20,000 BTO flats were launched for sale at Punggol and Sengkang and are expected to be completed soon. URA data also showed that about 2,200 and 10,000 private homes are expected to be completed in Jurong East/ West and thePunggol/Sengkang area over the next three to five years.

As for Bedok, it is a one of the most matured neighbourhood, yet there is only one fully-enclosed and air-conditioned neighbourhood mall - Bedok Point, which opened in Dec 2010. It has recorded 100% occupancy. Supply is expected to be transient. There is no new major commercial land supply in the suburban area since 2H11. Hence, retailers who want to have their presence in those growth areas would likely have to explore

leasing opportunities in those upcoming malls. Therefore, the take-up for these malls should remain healthy at 92% and 93%

Evidently, pre-commitment for new suburban malls being completed in the next 12 months appears to be on track as landlords of mega shopping malls tend to commence marketing well ahead of the completion of their developments.

Those that have been completed recently including JCube and Changi City Point, have achieved close to 100% occupancy.

Meanwhile, the two large suburban malls - Westgate and Jem that are expected to open by end of 2013, have achieved 50% and >90% pre-commitment respectively. We believe this a good indication of strong leasing demand in the suburban area as Jurong Gateway has the highest concentration of new malls. This should do well to allay any supply overhang concerns.

As such, occupancy should continue to stay above 95% next year and rent should grow by 2-3%, tracking the long-term inflation rate.

Advertise

Advertise