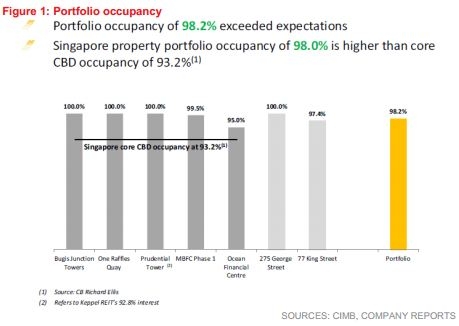

Here's a breakdown of Keppel REIT's amazing portfolio occupancy

The occupancy increased from 97% to 98.2%.

According to CIMB, 3Q12 distributable profit was up 93.6% due mainly to acquisitions. Qoq, DPU was up a marginal 1% on improved NPI and tax-transparency from MBFC Phase 1. Results provided a positive read-through of a stable office market:

Here's more from CIMB:

Take-ups remain positive, lifting portfolio occupancy to 98.2% from 97.0%, mainly from OFC (95.0% from 92.3%), Prudential Tower (100% from 99.5%) and 77 King Street (97.4% from 92.7%). Signing rents remained fairly stable at S$8-9psf at Prudential Tower andS$12-13psf at Ocean Financial Tower, with no additional incentives offered.

Leasing interest for the latter came from a mix of fund management and new-to-market legal firms.

Advertise

Advertise