Here's a one-stop reference for assets due for completion until 2015

Cross-check implied asset values and learn why S-REITs are now less loved.

According to CIMB, commercial developers have done well YTD, albeit from a very low base. The sector, it said, is trading at 28% discounts to RNAVs or 1.05x P/BV, still below their historical averages.

With S-REIT valuations now ahead of their implied asset values, CIMB now prefer developers.

S-REITs have been one of the best performers YTD, beating the FSSTI by 19%. The sector is now trading at 1.1x P/BV with forward dividend yields of 6%. Forward yield spreads have since been compressed by more than 170bp YTD to just 50bp above their long-term average of 408bp and 87bp

higher than their ex-crisis spread of 373bp.

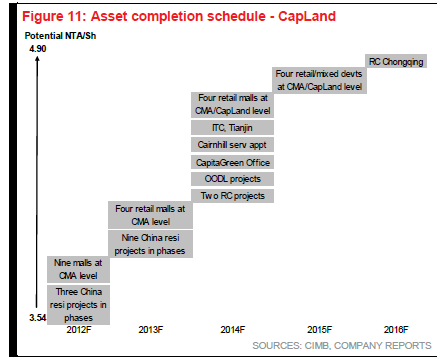

"Asset recycling is likely to remain their growth theme in FY13, particularly for developers with established REIT platforms. We believe developers are in an advantageous position given compressed REIT yields and elevated capital values. Development capex committed in the past may start to bear fruit in FY13-14 which should lift developers’ NTA. Developers with large development pipelines in 2013-15 include UOL, GLP, CMA and CapLand," it said in a report.

"Many Singapore developers have meaningful exposure to China, across segments like residential, logistics/warehouses and retail properties. We believe China could emerge as another source of growth next year. Recent PMI readings from China point to a turnaround in its real economy. Policy risks, in

our view, have also receded given stable physical prices," it added.

Advertise

Advertise