Staff Reporter

,

Singapore

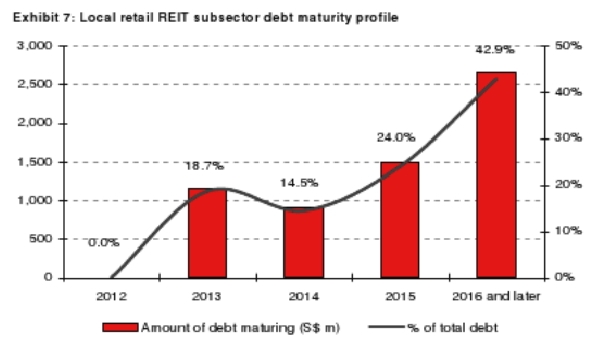

Only less than 20% of the total sector's debt is due to mature in 2013.

OCBC sees limited refinancing risks.

"In 2013, we note that only an estimated S$1.2b, or 18.7%, of the total subsector debt is due to mature (all borrowings in 2012 have been fully refinanced). Hence, we do not foresee any major refinancing risks across the local retail REIT subsector in the year ahead," said OCBC analyst Sarah Ong.

"In fact, the percentage of the outstanding loan facilities that is due to mature in each of the next three years does not exceed 25%. This is spread out well, in our view," she added.

Join Singapore Business Review community

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you dight and create an advertising campaign, in print and digital, on this website and in print magazine.

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Advertise

Advertise