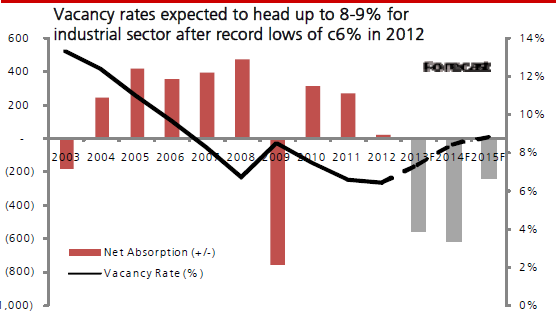

In case you haven't realized, higher space vacancy rates loom for all industrial sectors

2013-2015 supply is more than twice the annual supply seen in the past decade.

Based on the latest URA statistics, a total of 49.7m sqft (4.6m sqm) of industrial space is under construction/under planning and slated for completion over 2013-2015. When completed, total industrial stock is expected to increase by 12%. DBS Vickers notes that at an annualised increase of close to 16.5m sqft, this is more than double the annual completions over the past decade.

Here's more from DBS Vickers:

While all industrial sectors are expected to see increases, we note that in % terms, “Business Parks” space is looking at almost a 37% spike in available space while “Factory” and “Warehouse” segments are looking at increases of 6 and 17% respectively from current levels.

Vacancy rates to increase in all sub-sectors, spot rents for all sub-sectors expected to decline. Faced with an increasing supply outlook, we believe that this will cap the performance of the industrial physical market in 2012. Even after taking into account pre-commitments and projected new demand, we believe that spot rents will decline for most industrial subsectors as vacancy rates head up from current levels.

Among the various industrial sub-sectors, we highlight that (i) the Warehouse sector, after recording a 12% increase in median rents over 2011-2012, should see rents starting to decline with new competing supply while (ii) Business Parks should continue to feel the pressure from additional new supply entering the market on top of the already low average occupancy rate of c83% as of 3Q12. But downside will be cushioned by high precommitments of the new space completing over the next few years.

Advertise

Advertise