Rentals for factory and warehouse spaces surge by 6-7% in 2Q 2011

This is the fastest quarterly growth in three years.

Colliers expects rents and capital values of industrial properties to grow by more or less 10% in the second half of the year.

Here’s more form Colliers International :

| After the temporary lull in 1Q 2011 due to the Lunar New Year festive season, Singapore’s industrial property market picked up tempo in 2Q 2011, with both the sale and leasing markets experiencing a flurry of activity. The sales market was particularly robust as investors and occupiers were treated to a strong With high benchmark prices set by these new launches, owners of units in existing developments also raised their price expectations to ride on the up-cycle and buyers continued to bite. As a result, capital values of industrial properties turned in another quarter of growth, despite having surpassed 3Q 2008’s peak levels in the previous quarter. Following the tightening industrial stock, landlords have also raised their asking rentals to capitalise on the growing demand. As such, the average monthly gross rentals for prime factory and warehouse spaces surged by 6% to 7% QoQ in 2Q 2011, their fastest quarterly growth in three years. With economic activity staying elevated and manufacturing growth projected to be boosted by The average capital values for prime freehold factories on the ground floor climbed 3.2% QoQ By end-June 2011, prime ground floor factory and warehouse space were commanding average monthly gross rents of $2.25 per sq ft and $2.34 per sq ft, respectively. The average monthly gross rents for high-specs space stood at $3.41 per sq ft as of end-June 2011. After chalking up substantial gains of up to 12.6% in the first half of 2011, rents and capital values of industrial properties are expected to increase more moderately in the range of 10% in the second half of the year. |

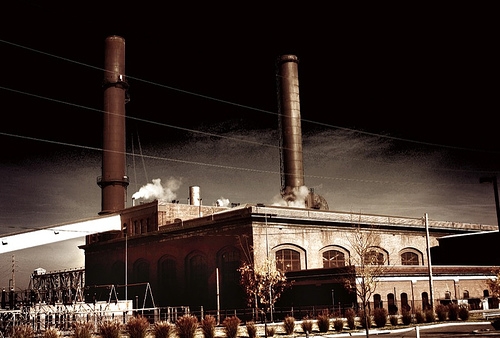

Photo from ChrisM70

Advertise

Advertise