Residential collective sales gaining momentum

Collective sale transactions in Singapore (y-t-d) amount to S$975.64 million, with over 90% of this total resulting from sale of properties in areas such as Balestier and Serangoon.

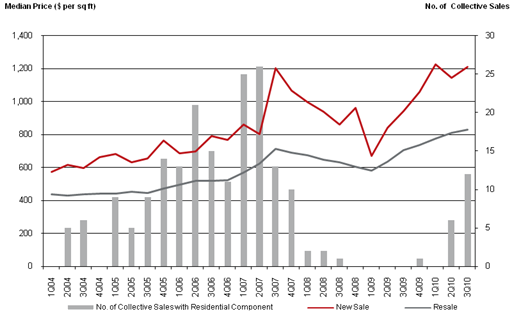

Stella Hoh, Head of Investments, Singapore, Jones Lang LaSalle commented, “The rise in popularity of collective sales this year could be attributed to improving fundamentals of the Singapore property market and the widening gap between new sale and resale prices for residential property.

“Median prices for new sales average at 48% above that of resale transactions during the first three quarters of 2010. These factors seem to have encouraged owners of older properties to band together and attempt a collective sale of the estate,” Hoh added.

In the current collective sale market, investor interest seems to be focused on the Central, City fringe and East Coast locations; however successful collective sales have been predominantly recorded in the upgraders’ locations including Balestier and Toa Payoh (District 12), Geylang and Eunos (District 14) and Serangoon, Serangoon Garden and Hougang (District 19). In particular, District 19 has stood out during 2010 in terms of transactional value. Jones Lang LaSalle recently closed the collective sale of Glenville at Lim Tua Tow Road off Upper Serangoon Road for S$39.51 million and set a benchmark price of S$740 psf ppr for the Serangoon area.

In line with the increase in the popularity of residential collective sales, there is evidence of a bounce back in terms of transactional value.The largest collective sale transacted so far this year was the sale of Meng Garden, which sold for S$137 million (or S$1,380 psf ppr). This is a significant quantum and still competitive when compared with the latest collective sales in the same vicinity that were transacted in third quarter of 2007.

Although mixed-use collective sales transaction value comprises just 5% of the total transaction volume to date, Quek Soh Hoon, Head of Commercial Investments Jones Lang LaSalle said, “While historically the focus has been on the residential sector rather than mixed use developments, large plots of freehold land such as Paramount Hotel and Shopping Centre (tender closing on 23 November 2010) are still generating interest among investors.

“Paramount Hotel and Shopping Centre offers investors a rare redevelopment opportunity to create a condominium development or a mixed-use development comprising hotel cum residential or commercial cum residential,” Quek said.

“As long as economic conditions continue to improve, we expect that collective sales prices will continue to trend up. Collective sales volumes will be maintained during 2011 in line with moderate growth in capital values expected off the back of recent government measures even as the price gap between new sale and resale prices remains large,” Hoh said.

View the graph here.

Advertise

Advertise