/CBRE

/CBRE

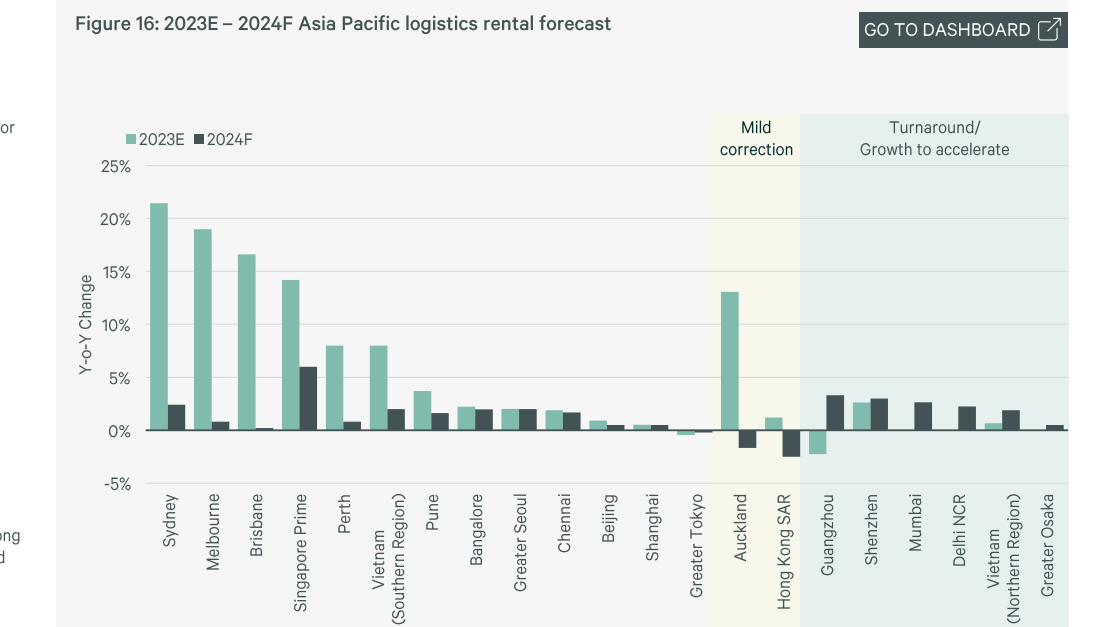

Singapore prime sheds to lead rental growth in APAC this year

Supply of prime logistics space to reach its peak in 2025.

Singapore’s prime logistics rents are projected to grow by 6% in 2024 and lead Asia Pacific’s slowing industrial real estate market, according to CBRE.

In its latest APAC Real Estate Market Outlook, the property agency sees rental growth for prime logistics in the Lion City dramatically easing this year after surging by 14% in 2023, largely due to the high volume of supply coming onstream next year.

CBRE said Singapore's prime logistics market will still likely record the highest annual rental growth in the region despite the slowdown.

Trailing behind the city-state is Guangzhou, China whose logistics rents are forecasted to expand by 3.3% this year and turn around from the 2.3% rental drop last year, followed by Shenzhen’s 3% projected rental growth, a tad higher than last year’s 2.6% expansion.

Across the Asia Pacific, CBRE expects leasing activity in the sector to stay muted as logistics occupiers turn cautious with their expansion plans. Room for rental growth across the region will remain limited as the ongoing sluggish demand will be met with rising supply this year.

On the flip side, it said demand will stay robust for high-end logistics properties this year driven by companies looking to upgrade to premium assets with modern transport networks, the latest technologies and sustainability features.

“Landlords will have to offer more incentives to induce expansion and/or relocation activity. CBRE expects face rents to remain stagnant, with a rise in incentives triggering a decline on a net effective basis,” the property consultancy added.

Advertise

Advertise