Chart from Colliers

Chart from Colliers

Singapore strikes a balance in logistics supply per capita, trade: report

The capital value of warehouses is still one of the highest in the region.

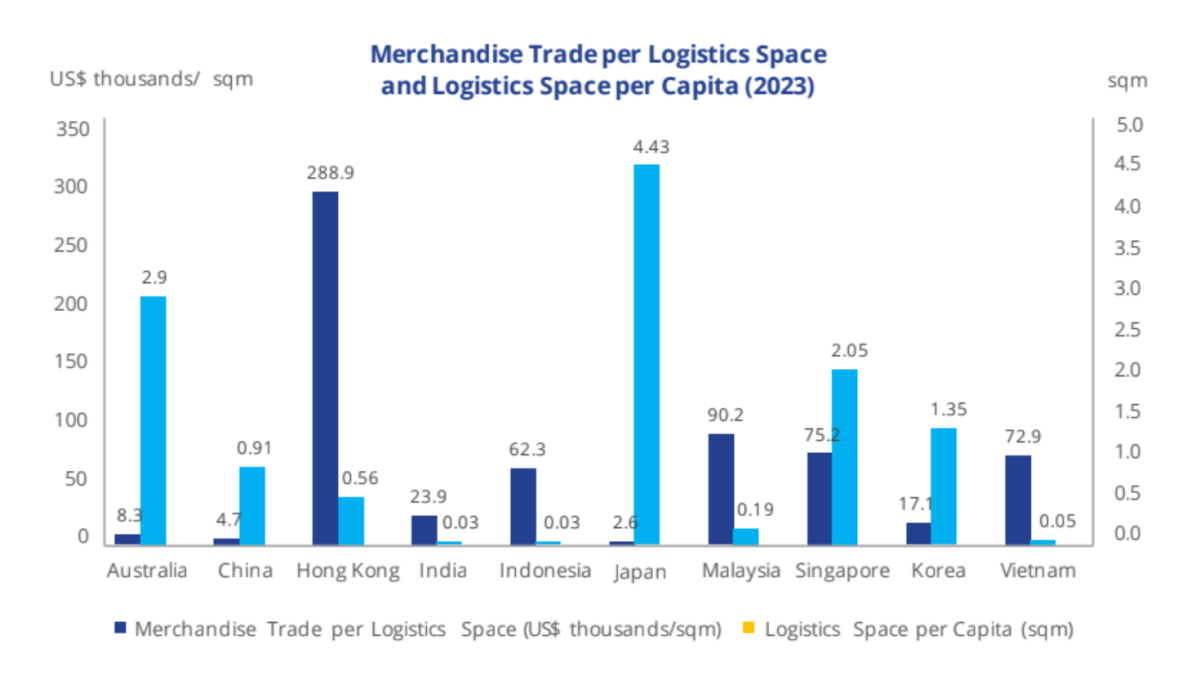

Singapore has a relatively balanced supply of logistics space per capita compared to other key markets in Asia, according to a study by Colliers.

There are about 2 square metres of logistics space available per capita in the city-state, joining Australia (2.9 sqm) and Japan (4.4 sqm) in having a balanced supply of logistics space among the 11 Asian markets surveyed by Colliers last year.

Singapore also posted the highest merchandise trade per logistics space among these three nations, recording US$75,200 worth of trade for every square metre of available space. This compares to Australia’s US$8,300 per sqm and Japan’s US$2,600 per sqm.

Driving the demand for logistics space in the city-state was the rapid growth of the e-commerce sector, coupled with sustained technological advancement and high internet penetration rates, according to Colliers.

It said e-commerce sales in the country grew fivefold between 2017 and 2023, in part due to the COVID-19 pandemic.

Being a land-scarce country, Singapore still recorded one of the highest average capital values of logistics space in the region at an average of US$2,006 per sqm for a 30-year leasehold warehouse, and US$5,650 per sqm for a freehold warehouse in 2023.

The high cost of land in the city-state stands in stark contrast to the lower capital values in emerging industrial hubs in the region like Vietnam where the average land value of warehouses was at US$605 per sqm, and Malaysia’s average capital value of US$568 per sqm.

“There is a mismatch in supply across various nations – Japan, Australia, and Singapore have managed a balance in logistics per capita and merchandise trade, but emerging markets like Vietnam and Malaysia offer the most compelling opportunities,” said Govinda Singh, Executive Director of Real Estate Advisory at Colliers.

“The region is expected to be one of the fastest growing globally in the near term and combined with a shift towards a China Plus One strategy, the demand for high-quality logistics space is set to intensify,” added Singh.

READ MORE: Industrial dealmaking and leasing activity slows in Q1

Advertise

Advertise