Photo from Shutterstock

Photo from Shutterstock

Singapore’s real estate to outperform in cross-border investments

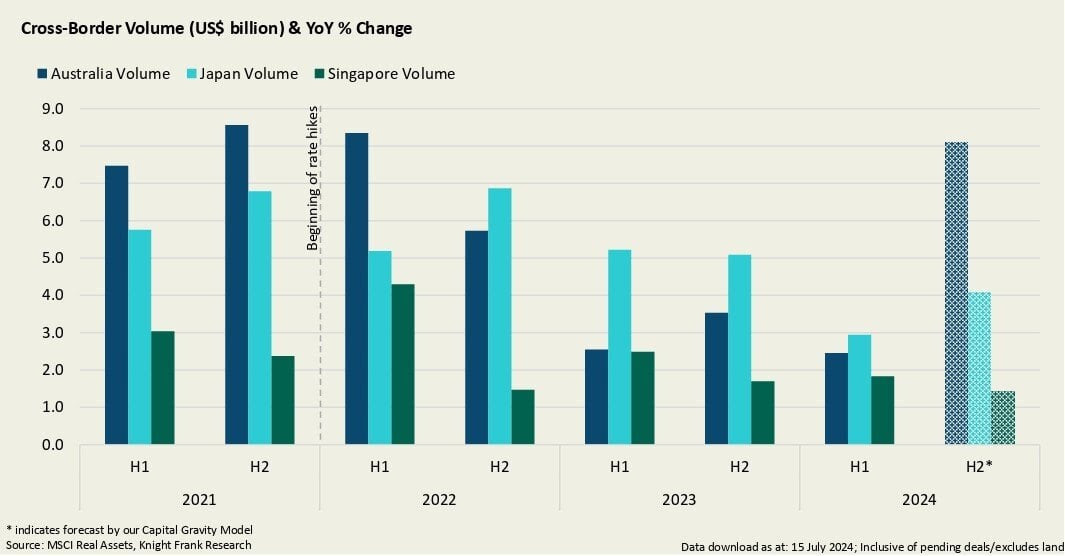

Knight Frank expects Singapore to account for 11% of cross-border capital trade in 2024.

Cross-border investments accounted for 48% of Singapore’s real estate investment volume in H1 2024, surpassing the 10-year average of 43%.

In Q2 2024 alone, Singapore saw a 63.8% YoY increase in its overall investment activity, with total cross-border volume amounting to US$756.8m.

Knight Frank noted that Singapore continued to “demonstrate healthy appeal to global capital” despite a general retreat from domestic and international investors.

The expert predicts Singapore to be among the top three markets for cross-border capital, behind Australia and Japan, and will account for 11% of trade for the full year.

Additionally, Knight Frank predicts that Singapore will receive 15% more volume from the office market and see heightened activity in the industrial sector, surpassing the long-term average, similar to the peaks of 2017/2018.

Advertise

Advertise