Thirty-three is a crowd: SREITs struggle for room in congested local market

SREITs are a victim of their own success.

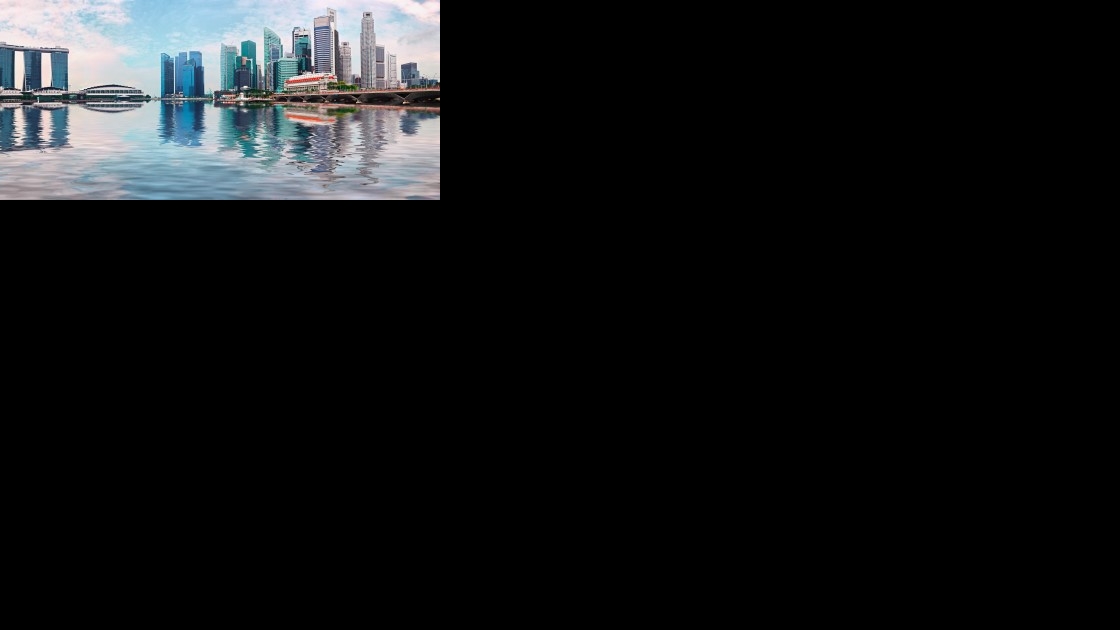

Singapore's REIT market has been overly successful in recent years, but SREITs may well be a victim of their own success.

Data from the Monetary Authority of Singapore show that the total assets of S-REITs grew 19.3% per year between 2007 and 2013, far outpacing the 7% growth per year in real estate trusts and funds globally.

According to PwC, the number of REITs has more than doubled to thirty-three in 3Q14 from just 16 in 2007. The congestion in the local market are pushing REITs to look elsewhere in their tireless quest for accretive assets.

SREITs have been snapping up assets in both established markets and emerging economies. Their portfolios now feature a number of properties in countries such as Japan, Australia, China, the Philippines, Indonesia, and Vietnam.

PwC notes that according to one Singapore-based REIT manager, "Some have been more successful than others, and a lot of that has been to do with the sponsors' ability to have more or less matured some of their own assets so they can easilty inject them into the REITs. Because investors want to see support in these far-off countries, where they don't have that big of a presence."

The migration of SREITs across the region is set to continue, as the overall success of these forays is one the sector's main drivers of growth.

Advertise

Advertise