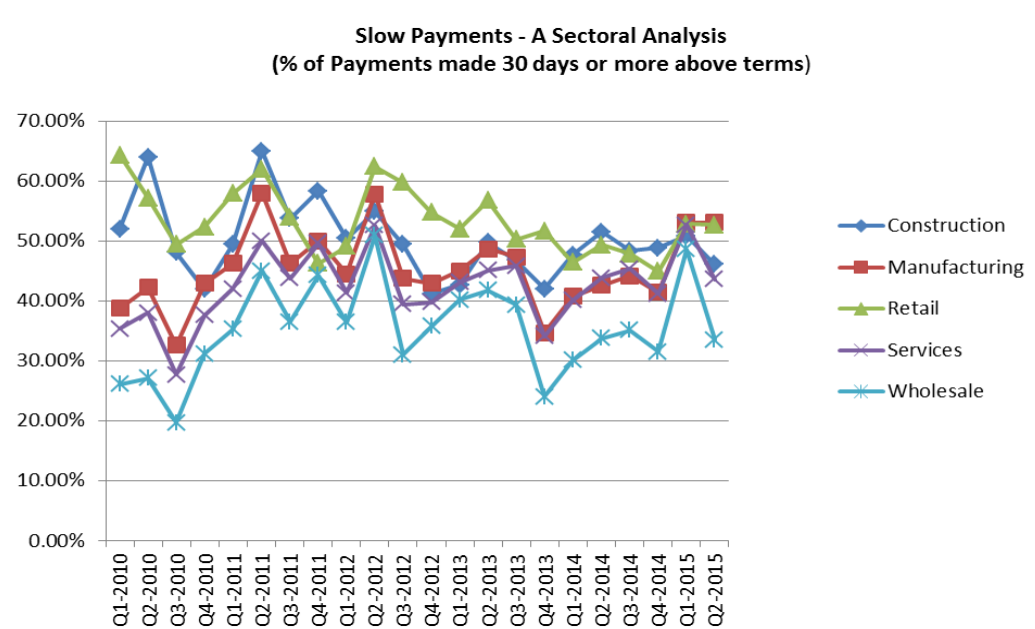

Chart of the Day: Manufacturers struggled with more payment delays in Q2

It was the worst-performing sector last quarter.

For the second consecutive quarter, the manufacturing sector recorded the highest proportion of slow payments in Q2 2015, according to the Singapore Commercial Credit Bureau.

The SCCB said that on a year-on-year basis, payment delays have surged by 10.49 percentage points from 42.56% in Q2 2014 to 53.05% in Q2 2015.

According to SCCB, slow payments dipped by a mere 0.01 percentage points from 53.06 per cent in Q1 2015 to 53.05 per cent in Q2 2015 q-o-q.

Manufacturers of transportation equipment recorded the highest proportion of payment delays at 53.25 per cent owing to weakness in the transport engineering cluster.

Print and publishing, and petroleum and coal recorded the second and third largest proportion of payment delays at 52.62 per cent and 49.15 per cent respectively.

Meanwhile, manufacturers of leather and leather products experienced the highest increase in slow payments by 12.03 percentage points from 14.29 per cent in Q1 2015 to 26.32 per cent in Q2 2015

“From a sectoral perspective, payment performance has improved with all five industries experiencing a decrease in proportion of slow payments q-o-q. This stands in contrast to Q1 2015 when all five industries experienced a rise in slow payments. This also marks the first time in nearly three years when all sectors experienced q-o-q declines in slow payments in Q3 2012. However, on a y-o-y basis, 2 of five industries [manufacturing and retail] experienced an increase in slow payments in Q2 2015,” SCCB said.

Advertise

Advertise