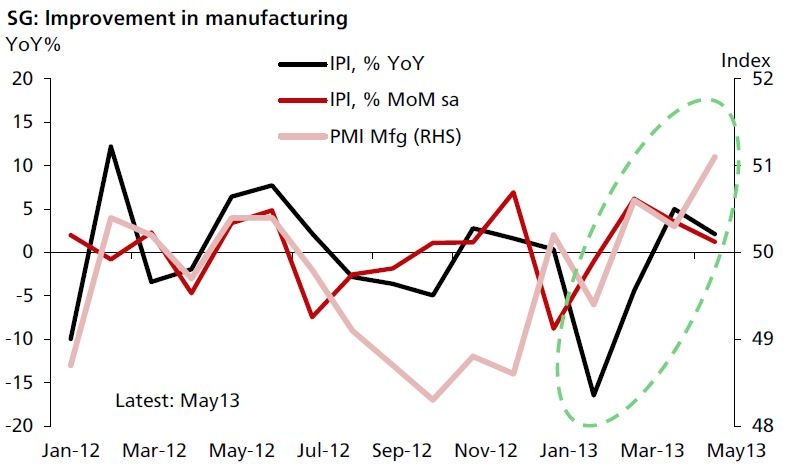

Chart of the Day: Manufacturing sector predicted to hit 51 points

Analysts won't be disappointed.

According to DBS, PMIs for Jun13 will likely show that the manufacturing sector is still in expansion mode. Market is looking for a reading of 51.0, more or less unchanged from 51.1 recorded in the previous month.

DBS thinks the final outcome will not disappoint and should come in fairly in line with expectation.

Here's more from DBS:

This upcoming set of numbers is particularly important in the sense that the overall industrial index for April and May have been more correlated to the PMIs than the non-oil domestic export figures that most analysts like to refer to.

But we’ve pointed out in our previous writings that the NODX hasn’t been a good gauge of the overall economic performance of the economy as it has been distorted by a combination of base, currency and price effects.

That explains why we have placed out bets on the PMIs in forecasting the growth pace of the manufacturing sector.

And for April and May, industrial production grew an average of 3.6% YoY or 2.4% MoM sa (see Chart). That’s decent growth pace considering the placid outlook for the global economy.

More importantly, the overall manufacturing PMI averaged 50.7 over the two months period. So if June PMI is able to come in within expectation at 51.0, expect the manufacturing sector and indeed the overall economy to register a healthy rebound in the second quarter.

Advertise

Advertise