Rising PMI could signal stabilising manufacturing environment: analysts

The increase was in line with improving PMI readings in Vietnam, China, Thailand and South Korea.

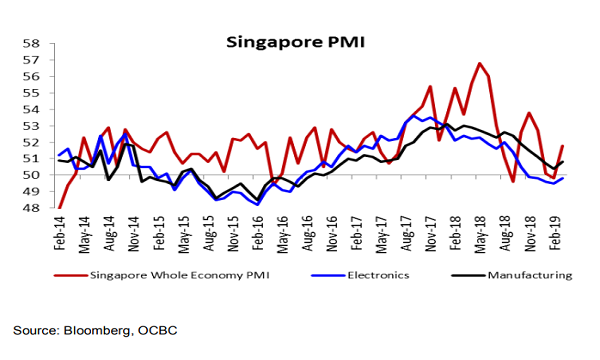

The modest improvements in the manufacturing and electronics purchasing manager’s index (PMIs) by 0.4 and 0.3 points respectively, to 50.8 and 49.8 reinforce the tentative economic green shoots seen earlier in the China PMIs and US manufacturing ISM data, according to a report by OCBC Treasury Research.

Most of Asia including Vietnam, Indonesia, China, Thailand, Taiwan and South Korea saw improved PMI readings in March, UOB’s Global Economics & Markets Research added. Looking into Singapore-centric PMI, the growth in new export orders seen in both SIPMM and IHS readings may likely suggest that Asia’s trade environment has picked up in March.

“The gains were mostly in the new orders, new exports and factory output gauges which were encouraging, but the order backlog indices still continued to contract which suggested that the external demand story is not completely out of the woods yet,” Selena Ling, head of Treasury Research & Strategy, Global Treasury Division at OCBC Bank, said in a statement.

Pending a convincing resolution of the US-China trade talks, Ling noted that the increase could be interpreted as initial signs suggestive of spring following a harsh winter, especially coming from February which was a low base due to the Chinese New Year festive season.

This was echoed by UOB economist Barnabas Gan, who noted that the rise in the PMI readings could likely be seasonal in nature.

“Nevertheless, it also confirms our cautiously-optimistic view as written in our latest Industrial Production report, in which February’s manufacturing pace has picked up 0.7% on a YoY basis. Accounting for the upbeat March PMI reading, we pencil March’s manufacturing growth to be 2.4% YoY whilst keeping our full-year manufacturing outlook at 3.0% for 2019,” he said.

Barring further signs of pickup in both business and consumer confidence, Ling noted that it is still difficult to see manufacturing or electronics emerging as the key growth driver for H1 growth for the Singapore economy at this juncture. “We see Q1 2019 GDP growth at a relatively lackluster 1.8% YoY amidst a tepid manufacturing performance,” she said.

Advertise

Advertise