UMS takes over JEP Holdings following manadory cash offer

Once the offer is completed, UMS would own 53.7% of JEP's issued shares.

UMS Holdings Limited has issued a mandatory unconditional cash offer for Catalist-listed JEP Holdings.

In disclosures posted on the Singapore Exchange (SGX), UMS reported that it would by 54,229,355 ordinary shares of JEP at $0.20 per unit, or an aggregate price of $10,845,871. This is approximately 13.1% of the total number of issued and paid-up shares of JEP.

Following this deal, UMS would own 222,626,325 of JEP's shares, or approximately 53.79% of the total issued and paid up shares. UMS plans to maintain JEP's listing status.

Andy Luong, who serves as executive chairman and CEO of both companies, had abstained from participating in the deliberations regarding the offer, according to the statements submitted to SGX.

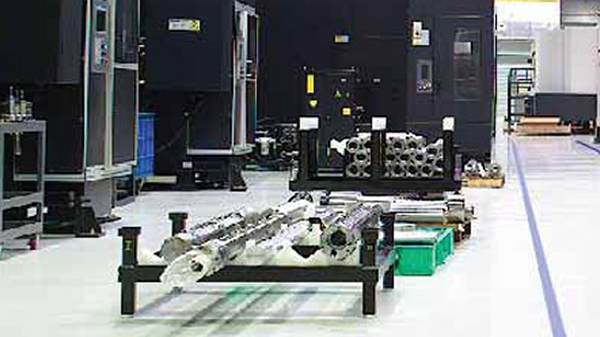

The move would lead UMS to diversity its operations past its traditional semiconductor business, as JEP is primarily engaged in precision machining and engineering services solutions.

UMS was among the top five traded tech stocks for the first nine weeks of 2021.

Advertise

Advertise