Singapore

Great Eastern clinches Mobile Award for life insurance at first-ever TEA

Great Eastern's UPGREAT and GETGREAT apps combine health and wellness with rewards to drive a better community.

Great Eastern wins Digital Award for life insurance in SBR's first Technology Excellence Awards

Great Eastern received the Digital Award for life insurance during Singapore Business Review’s recently concluded Technology Excellence Awards.

NTUC Income Insurance Co-operative garners SBR Technology Excellence Award for Digital - Personal Insurance

Droplet, a pioneering insurance product, enables passengers to deal with surge pricing by private ride-hailing platforms on rainy days.

SP Telecommunications captures the SBR Technology Excellence Award for IoT - Telecommunications

Through SP Telecom’s platform, businesses can benefit from IoT without hefty upfront investments and long lead times for set-up and deployment.

Singapore FinTech Association launches RegTech sub-committee

It aims to promote and adopt technologies to overcome regulatory challenges.

Epicentre Holdings cancels private placement after failure to contact CEO

The firm is also facing repayment demands from three creditors.

Pacific Star assigns RSM to liquidate aluminum business

The firm’s GM and executive VP Seet Li Ming Andrew also resigned.

Sevak exits SGX-ST's watchlist

It has been on the watchlist since March 2015 due to buyback issues.

URA tenders residential-with-commercial Bernam Street site

It can yield up to 325 potential units.

IHH Healthcare profits surged 56.39% to $29.42m

Parkway Pantai’s revenue climbed 49% to $847.49m. IHH Healthcare began the year on a bright note as its profits climbed 56.30% YoY to $29.42m (MYR89.51m) in Q1 from $18.81m (MYR57.23m) during the same period a year ago. Revenue also jumped 17.19% YoY to $1.20b (MYR3.64b) from $940m (MYR2.85b) in Q1 2018. Revenue from Parkway Pantai, the group’s largest operating subsidiary, rose 49% YoY to $847.49m (MYR2.57b), thanks to the sustained organic growth from existing operations and the continued ramp-up of Gleneagles Hong Kong Hospital, as well as contribution from newly acquired Amanjaya and Fortis. The increase in revenue also included a one-off $9.37m (MYR28.5m) trustee management fee income from RHT relating to the sale of the RHT assets. In Singapore, Parkway Pantai’s inpatient admissions decreased 1.2% to 19,118, but average revenue per inpatient admission grew 7.0% to $10,441 (MYR31,772). Acibadem Holdings, a private healthcare provider in Turkey where IHH owns a 90% stake, saw revenue decline 5% to $317.81m (MYR967.1m). Inpatient admissions decreased 3% to 58,364 but revenue intensity grew 27.2% to $2,660 (MYR8,094) on a combination of price adjustments for patients on private insurance and paying out-of-pocket, taking on more complex cases and an increase in foreign patients. IMU Health, the group’s medical education arm, saw revenue slip 4% to $20.28m (MYR61.7m) mainly due to lower student intake and population for some of its courses. Meanwhile, PLife REIT’s revenue grew 4% to $11.7m (MYR34m) backed by contribution from a nursing rehabilitation facility acquired in February 2018. “Our decisive actions in Turkey to pare down $344.92m (US$250m) of non-Lira debt last month will reduce forex volatility on earnings from the second quarter onwards. In Greater China, we ramped up operations in Gleneagles Hong Kong with new service offerings catering to demand, while the development of Gleneagles Chengdu and Gleneagles Shanghai continues on track,” IHH managing director and CEO Tan See Leng said. In its financial report, IHH said that it will focus on ramping up its existing operations and integrating Fortis in the near to medium term. The group will also increasingly leverage technology to increase its productivity and service offerings, including adopting more advanced medical treatments and to improve clinical outcome.

Alliance Healthcare debuts after raising $4.5m via IPO

The company opened at $0.205 apiece.

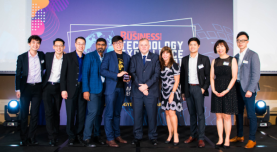

Singapore's most innovative companies recognised at the Singapore Business Review Technology Excellence Awards 2019

Close to 150 corporate leaders graced the awards ceremony.

SPH to issue $150m perpetual securities

They will be issued in denominations of $250,000 on 7 June.

Mapletree Investments' profits up 10.3% to $2.16b in 2018

Its acquisitions in Australia, the US and Europe bolstered earnings.

M1's mobile plan consolidation could deepen losses in industry postpaid revenue

Singtel and StarHub could revamp their bundled plans to compete with M1’s base plan.

Daily Markets Briefing: STI down 0.64%

Don’t expect gains today.

Advertise

Advertise