Singapore

SIA Engineering profits down 13.9% to $160.9m in FY2018/2019

Falling airframe and fleet management revenues hit earnings.

SIA Engineering profits down 13.9% to $160.9m in FY2018/2019

Falling airframe and fleet management revenues hit earnings.

Keppel O&M arm clinches offshore wind farm contract worth over $150m

It will engineer and construct two 600MW offshore wind farm substations in Taiwan.

Wilmar International profits jumped 26.4% to $349.3m in Q1

Pre-tax profit in the tropical oils segment skyrocketed 81% to $250.88m. Wilmar International started the year with a bang as net profit climbed 26.4% YoY to $349.3m (US$257m) in Q1 driven by better results in tropical oils, sugar and consumer products. The firm noted that its tropical oils (plantation, manufacturing & merchandising) saw an 81% surge in pretax profit to $250.88m (US$183.8m) boosted by stronger sales volume and margins from the manufacturing and merchandising businesses. However, this was partially offset by lower crude palm oil (CPO) prices and production yields, which reduced the contributions from the plantation business. Meanwhile, the oilseeds & grains (manufacturing & consumer products) business saw its pretax profit almost halved (47.2%) to $124.35m (US$91.1m) from $235.59m (US$172.6m) a year ago. The segment succumbed to weaker results from the crushing business, which had been impacted by the African swine fever outbreak in China and a sharp drop in Brazilian soybean basis. For the sugar (milling, merchandising, refining and consumer products), pretax profit recovered to $2.32m (US$1.7m) from a loss of $53.23m (US$39m) a year ago, thanks to the stronger performance from refining and merchandising activities as well as the contributions from Shree Renuka Sugars Limited, in line with the ongoing sugar milling season in India. Meanwhile, the share of results from joint ventures & associates saw a 50% decrease to $28.53m (US$20.9m) as the stronger performances by the group’s Europe and Vietnam investments were offset by weaker contributions from the African associates and investments in China. Wilmar’s earnings per share jumped 28.1% to $0.56 (US$0.41) from $0.44 (US$0.32) a year ago.

Oyster Bay Fund mulls $500m investment into Hyflux

It is also looking to buy Hyflux shares for up to $26m.

Daily Briefing: Online food startup Grain raises $10m in series B funding; Woodleigh Residences launched sale for a minimum of $1,733 per sqft

And check out which Singapore-based REITs is the cheapest.

Singapore telcos brace for higher costs amidst 5G rollout

The leverage of Singtel is set to increase to 2.3x-2.5x in FY19.

Daily Markets Briefing: STI up 0.12%

Don’t expect gains today.

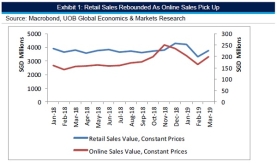

Chart of the Day: Retail sales down 1% in March

Sales of optical goods & books, food & beverages and telecommunications & computers declined.

Maybank Singapore targets the elderly in new integrated banking package

They will have access to products such as endowment and retirement plans.

Nanjing opens up more innovation opportunities to Singapore firms

Firms can leverage on the Singapore-Nanjing Eco Hi-Tech Island to trial sustainable urban solutions.

MAS issues prohibition orders against three individuals for dishonest conduct

They include former representatives of Jefferies Singapore and Legacy FA.

Ascendas Hospitality Trust's FY2018/2019 NPI slipped 2.3% to $87.23m

Lower contribution from its Australia hotels hit yearly income.

Changi nabs seventh spot in global airport rankings

It lags behind Hamad International Airport and Tokyo International Airport.

OUE C-REIT's NPI up 23.5% to $43.57m in Q1

Earnings were boosted by OUE Downtown Office.

OCBC's profit jumped 11% to $1.23b in Q1

Non-interest income surged 24% to $1.14b.

SGX RegCo suspends trading of Best World shares amidst short seller attacks

The suspension will continue until investigations into its China sales have been completed.

SGX daily average value up 2% to $1.05b in April

Total derivatives traded volume rose 37% YoY to 20.8 million contracts. Securities daily average value (SDAV) in the Singapore Exchange (SGX) gained 2% MoM to $1.05b during April, whilst market turnover value for Exchange Traded Funds (ETFs) rose 44% to $195m, according to an announcement. Assets under management for STI Exchange Traded Funds (ETFs) reached a milestone in April as fund size exceeded $1b. Total derivatives traded volume rose 37% YoY to 20.8 million contracts, as global demand for risk management across asset classes continued. Total securities market turnover by volume was up 7% MoM to 22.9 billion shares, driven largely by real estate and consumer sectors. The local bourse also noted that overall commodity derivatives volume increased 64% YoY, with volumes of iron ore and freight derivatives up 73% and 53% YoY, respectively. Amidst swings across regional equity markets, the Singapore stock market was the best performing market globally in April. The Straits Times Index (STI) surpassed the 3,400 mark, generating 6.1% increase in total returns, propelled by Banks (+10.8%) and Utilities (+6.6%) sectors.

Advertise

Advertise