Singapore

SIA profit crashed 47.5% to $682.7m in FY19

Rising expenses from steep fuel costs hit earnings.

SIA profit crashed 47.5% to $682.7m in FY19

Rising expenses from steep fuel costs hit earnings.

Chart of the Day: Elderly to account for a fourth of Singapore's population by 2030

This will boost domestic patient volumes.

Singapore bank NIMs up 3bps in Q1

UOB was the only weak link as margins shrunk 5bps.

Daily Briefing: GK Goh Holdings offers $184.5m to acquire BoardRoom; Property development firm Metro Holdings acquires 50% stake in CICC Qihang Fund

And Pan Pacific Hotels Group to debut in London on 2020.

Daily Markets Briefing: STI up 0.2%

Expect muted gains today.

Asset-based finance platform HPD Lendscape opens Singapore office

This marks its first Southeast Asian foothold.

Temasek's Vertex Ventures raises US$230m in first close of Southeast Asian fund

The fund will back tech startups in the region and India.

Public transport payment via Visa to go live on June 6

The LTA already made the contactless payment service available with Mastercard in April.

SLA and URA call for proposals to renovate state properties

Bukit Timah Fire Station and Old Kallang Airport are some of the properties that will be part of the programme’s first phase.

Frasers Centrepoint Trust to raise $421.7m via equity fund

The proceeds will be partially used to fund the acquisition of Sapphire Start Trust units.

Better traction in Smart City solutions could boost ST Engineering's order book

Its Newtec acquisition and satellite communications business makes it a standout for Smart City initiatives.

Singapore and Malaysia kick off first meeting on maritime boundary delimitation

They will build a sub-committee to address the legalities of the delimitation.

Hyflux secures non-binding letter of interest from interested investor

The investor is targeting Hyflux assets in the Middle East and North Africa. Hyflux received a non-binding letter of interest from a potential investor eyeing to acquire certain assets of the firm in Algeria and Oman, as well as other assets in the Middle East and North Africa region. According to an announcement, the said investor is also interested in the operation and maintenance activities related to the assets. Particularly, Hyflux revealed that the investor intends the proposed transaction to grow the investor’s portfolio of desalination plants. “The company understands that the investor is one of the top 10 largest desalination companies globally,” Hyflux said, noting that the investor is one of the world’s leading infrastructure companies and is a specialist in engineering, construction, operation and maintenance of water treatment facilities. “The investor is conscious of the timeline and has indicated that it would be willing to devote all necessary resources to ensure that the due diligence process and the consummation of the proposed transaction are carried out in the shortest possible timeframe,” Hyflux added. The Singapore firm said that whilst it is considering all serious offers and expressions of interest received, the priority remains for a strategic investor for the entire group.

Sembcorp Industries could bank on Indian business recovery

Its renewable generation pumped in $15-20m profits a quarter in 2018. Sembcorp Industries may be able to see even brighter days with the recovery of its power business in India, according to DBS Equity Research analyst Pei Hwa Ho. “We believe in the long-term growth prospects of SCI’s Energy arm, which has expanded its global footprint into key emerging markets – India, Bangladesh, Vietnam and Myanmar,” Ho noted. The analyst noted that the firm’s India operations swung from a loss of $58m in 2017 to a profit of $47m in 2018, and that the positive trend should continue. “The power market in India is recovering with current peak surplus expected to reverse by FY20 according to independent research house CRISIL, driving up tariffs. India remains a key growth driver, accounting for 15-20% of earnings,” Ho explained.

CDL invests $1.1b in Chinese real estate firm Sincere Property Group

The firm will indirectly hold a 24% stake in Sincere.

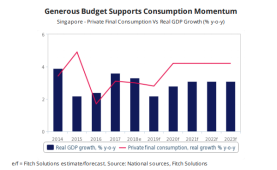

Private consumption to hit 2.8% amidst Budget 2019 boosts

It is expected to outpace the country’s economic growth at 2.2%.

SIA Group's passenger load factor up 0.8 ppt in April

Passenger carriage rose 7.6% compared to last year.

Advertise

Advertise